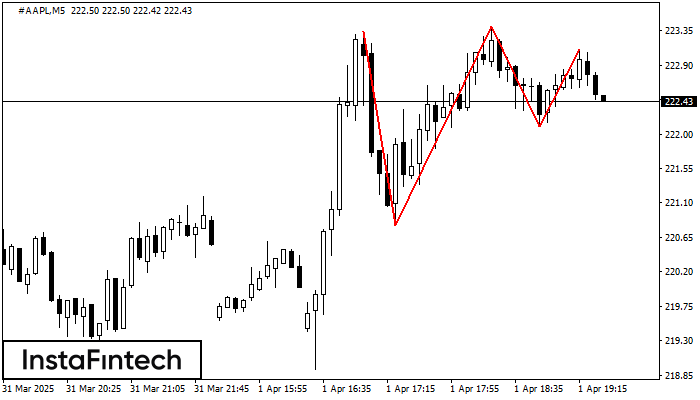

Triple Top

was formed on 01.04 at 18:30:11 (UTC+0)

signal strength 1 of 5

The Triple Top pattern has formed on the chart of the #AAPL M5. Features of the pattern: borders have an ascending angle; the lower line of the pattern has the coordinates 220.81/222.10 with the upper limit 223.34/223.11; the projection of the width is 253 points. The formation of the Triple Top figure most likely indicates a change in the trend from upward to downward. This means that in the event of a breakdown of the support level of 220.81, the price is most likely to continue the downward movement.

The M5 and M15 time frames may have more false entry points.

Vea asimismo

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

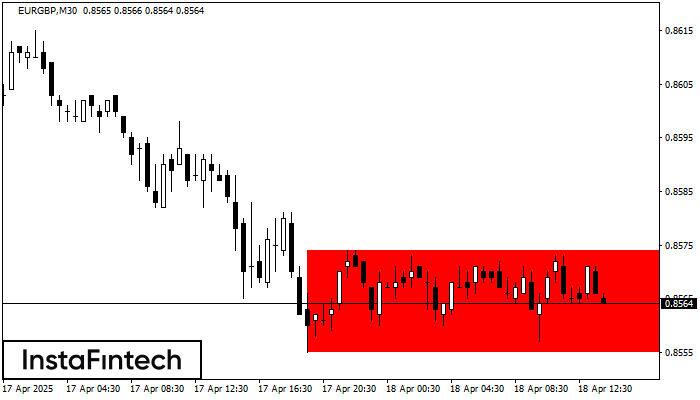

Bearish Rectangle

was formed on 18.04 at 13:00:27 (UTC+0)

signal strength 3 of 5

According to the chart of M30, EURGBP formed the Bearish Rectangle. This type of a pattern indicates a trend continuation. It consists of two levels: resistance 0.8574 - 0.0000

Open chart in a new window

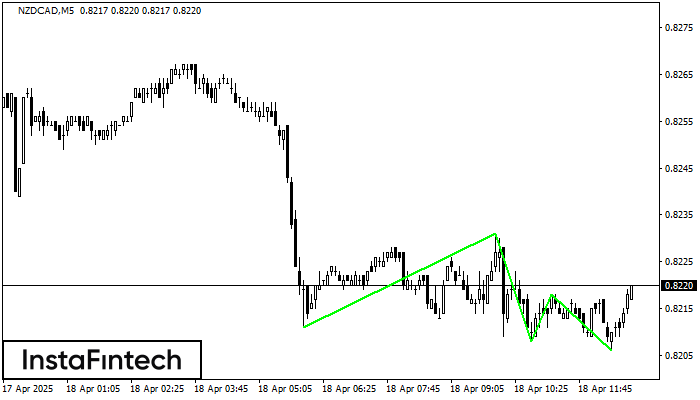

Triple Bottom

was formed on 18.04 at 11:50:33 (UTC+0)

signal strength 1 of 5

The Triple Bottom pattern has formed on the chart of the NZDCAD M5 trading instrument. The pattern signals a change in the trend from downwards to upwards in the case

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

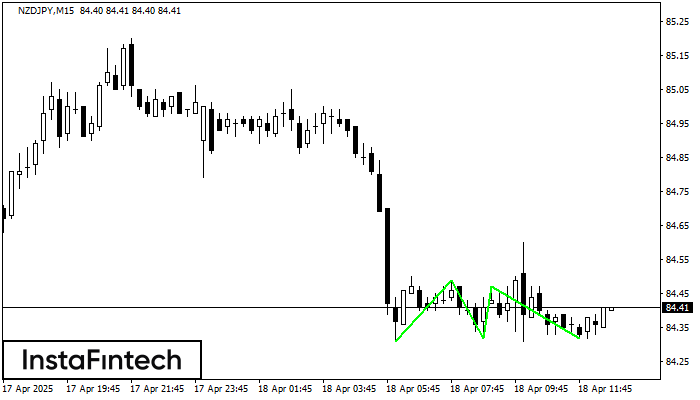

Triple Bottom

was formed on 18.04 at 11:45:33 (UTC+0)

signal strength 2 of 5

The Triple Bottom pattern has been formed on NZDJPY M15. It has the following characteristics: resistance level 84.49/84.47; support level 84.31/84.32; the width is 18 points. In the event

The M5 and M15 time frames may have more false entry points.

Open chart in a new window