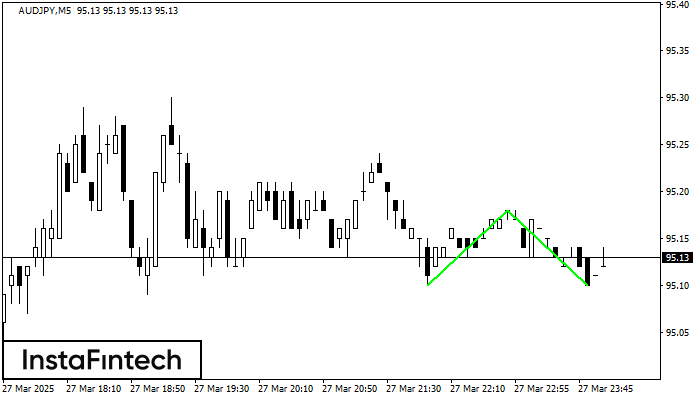

Double Bottom

was formed on 28.03 at 00:06:07 (UTC+0)

signal strength 1 of 5

The Double Bottom pattern has been formed on AUDJPY M5. This formation signals a reversal of the trend from downwards to upwards. The signal is that a buy trade should be opened after the upper boundary of the pattern 95.18 is broken. The further movements will rely on the width of the current pattern 8 points.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength