Vea también

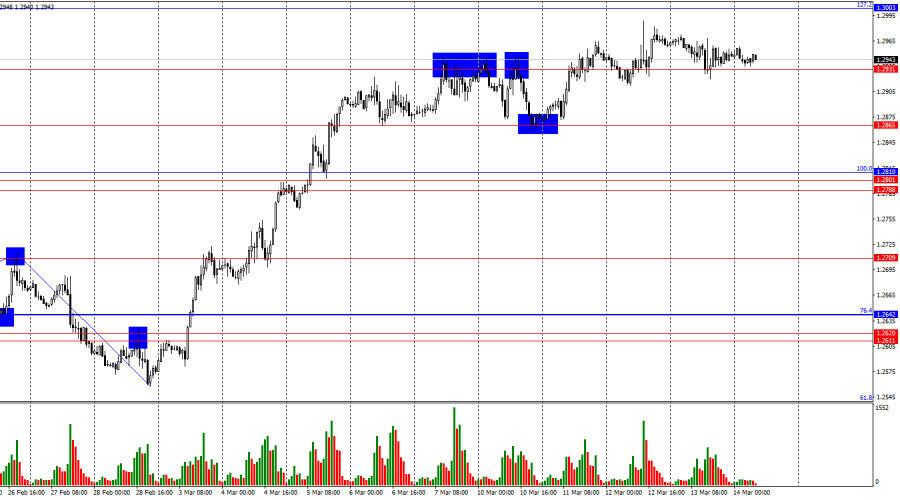

On the hourly chart, GBP/USD retraced to 1.2931 on Thursday, where bearish momentum faded. Another test of this level occurred today, but overall, the pound has been moving sideways over the past few days. A break below 1.2931 would allow for a decline toward 1.2865 and 1.2810, while a rebound from this level could push the pair toward the 127.2% corrective level at 1.3003.

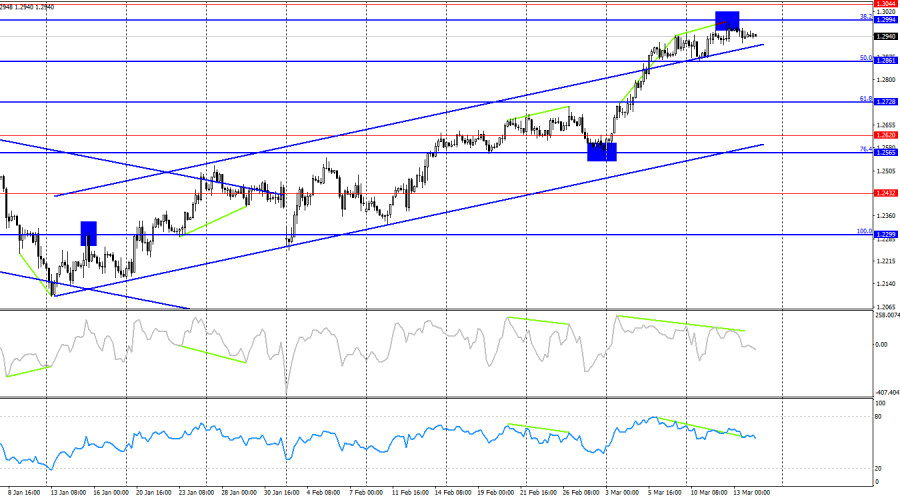

The wave structure is absolutely clear. The last completed downward wave failed to break the previous low, while the last upward wave broke the previous peak. This suggests that a bullish trend remains in place. The pound has shown strong growth recently—perhaps even excessively strong. The fundamental background is not strong enough to justify continuous buying pressure without corrections or pauses. However, most traders avoid buying the U.S. dollar regardless of economic data, as Donald Trump keeps imposing new tariffs, which will eventually slow U.S. and global economic growth.

Thursday's fundamental data was mixed, while Friday's morning reports were clear-cut. The UK released its first and last major reports for the week, revealing that GDP for January declined by 0.1% month-over-month, against expectations of a 0.1% increase. Industrial production volumes dropped by 0.9% month-over-month, while forecasts pointed to only a 0.1% decline. These figures provided a logical reason for bears to take control, yet after two weeks of pound appreciation, there has been no correction, pullback, or response to economic data in favor of the dollar.

The 1.2931 level is not strong enough to act as an insurmountable barrier for the market. The issue lies in traders' lack of interest in buying the U.S. dollar—which remains absent. The reason continues to be U.S. foreign policy and Donald Trump's actions.

On the four-hour chart, GBP/USD continues to rise after consolidating above the 50.0% Fibonacci level at 1.2861. A strong pound decline is unlikely unless prices close below the upward channel. The CCI indicator has formed a bearish divergence, but this has not yet affected bullish positioning. A rebound from 1.2994 could trigger a decline toward 1.2861, but there are no sellers in the market.

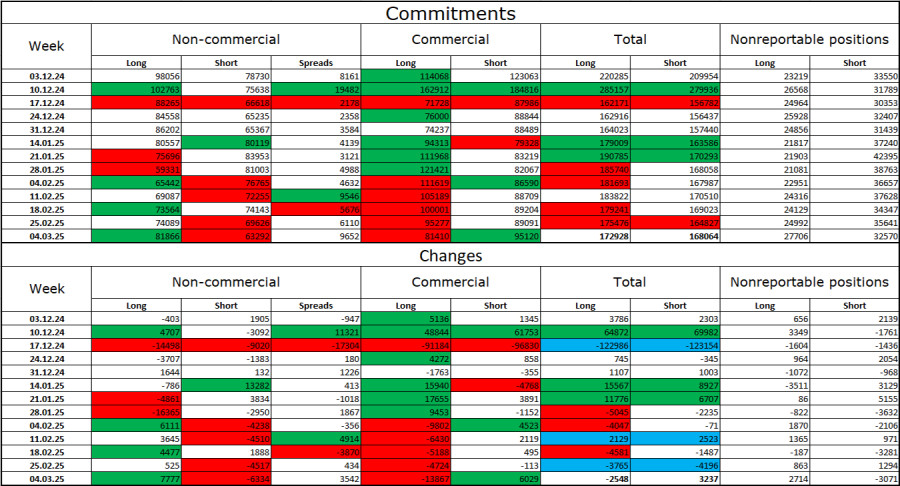

The Non-commercial traders' sentiment has become less bearish over the last reporting week. The number of long positions increased by 7,777, while the number of short positions decreased by 6,334. Bears have lost their market advantage. The gap between long and short positions has now widened to nearly 20,000 in favor of bulls: 82,000 long vs. 63,000 short.

I believe that GBP/USD still has downward potential, but recent developments may force a long-term market reversal. Over the past three months, the number of long positions declined from 98,000 to 81,000, while the number of short positions dropped from 78,000 to 63,000. Over time, professional traders may reduce long positions or increase shorts, as most bullish factors for the pound have already played out. However, a sudden shift in sentiment toward the U.S. economy due to Donald Trump may deter traders from buying the dollar or selling the pound.

Friday's economic calendar includes three key events, two of which have already been released. The impact of fundamental data on market sentiment for the rest of the day is expected to be limited.

Selling the pair is possible today after a rebound from 1.2994 on the four-hour chart or after a close below 1.2931 on the hourly chart, with targets at 1.2865 and 1.2810. Buying opportunities arise after a rebound from 1.2931 on the hourly chart, with a target of 1.2994.

Fibonacci levels are drawn from 1.2809–1.2100 on the hourly chart and from 1.2299–1.3432 on the four-hour chart.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

InstaForex en cifras

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.