#KO (Coca-Cola Company). Exchange rate and online charts.

Currency converter

14 Apr 2025 22:59

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

The Coca-Cola Company, incorporated in September 1919, is a beverage company. The Company owns or licenses and markets more than 500 nonalcoholic beverage brands, primarily sparkling beverages but also a variety of still beverages, such as waters, enhanced waters, juices and juice drinks, ready-to-drink teas and coffees, and energy and sports drinks. It owns and markets a range of nonalcoholic sparkling beverage brands, which includes Coca-Cola, Diet Coke, Fanta and Sprite. The Company’s segments include Eurasia and Africa, Europe, Latin America, North America, Pacific, Bottling Investments and Corporate. On December 30, 2011, the Company acquired Great Plains Coca-Cola Bottling Company (Great Plains) in the United States. During the year ended December 31, 2011, the Company acquired the remaining interest in Great Plains and Honest Tea, Inc. (Honest Tea). In December 2011, the Company acquired an additional minority interest in Coca-Cola Central Japan Company (Central Japan). In September 2012, it acquired approximately 50% equity in Aujan Industries’ beverage business.

The Company markets, manufactures and sells beverage concentrates, sometimes referred to as beverage bases, and syrups, including fountain syrups, and finished sparkling and still beverages. Outside the United States, it also sells concentrates for fountain beverages to its bottling partners. The Company sells sparkling beverages and a variety of still beverages, such as juices and juice drinks, energy and sports drinks, ready-to-drink teas and coffees, and certain water products, to retailers or to distributors, wholesalers and bottling partners who distribute them to retailers. In addition, in the United States, it manufactures fountain syrups and sells them to fountain retailers, such as restaurants and convenience stores who use the fountain syrups to produce beverages for immediate consumption, or to authorized fountain wholesalers or bottling partners who resell the fountain syrups to fountain retailers.

The Company manufactures, markets and sells Leao / Matte Leao teas in Brazil through a joint venture with its bottling partners. During 2011, the Company introduced a variety of brands, brand extensions and beverage products: the Latin America group launched Frugos Sabores Caseros; in the Pacific group, Fanta, a fruit-flavored sparkling beverage, was relaunched in Singapore and Malaysia; Real Leaf, a green tea-based beverage, launched two varieties in Vietnam; and in South Korea it introduced three flavor variants of the Georgia Emerald Mountain Blend ready-to-drink coffee beverage and Burn Intense, an energy drink; the Europe group launched Powerade ION4 in Denmark, Norway, Sweden and France, France launched Powerade Zero; in the Eurasia and Africa group, Turkey launched Cappy Pulpy, and India launched Fanta Powder, an orange-flavored powder formulation; Schweppes Novida, a sparkling malt drink, was launched in Kenya and Uganda; and in Uganda Coca-Cola Zero was launched; in Egypt, it launched Cappy Fruitbite; and Schweppes Gold, a sparkling flavored malt drink, and in Ghana, it launched Schweppes Malt, a dark malt drink. During 2011, the Company sold approximately 26.7 billion unit cases of its products.

The Company’s core sparkling beverages include Coca-Cola, Sprite, Fanta, Diet Coke / Coca-Cola Light, Coca-Cola Zero, Schweppes, Thums Up, Fresca, Inca Kola, Lift and Barq's. Its energy drinks include Burn, Nos and Real Gold. Its juices and juice drinks include Minute Maid, Minute Maid Pulpy, Del Valle, Simply, Hi-C, Dobriy and Cappy. The Company’s other still beverages include glaceau vitaminwater and Fuze. The Company’s coffees and teas include Nestea teas, Georgia coffees, Leao / Matte Leao teas, Sokenbicha teas, Dogadan teas and Ayataka teas. Its sports drinks include Powerade and Aquarius. The Company’s waters include Ciel, Dasani, Ice Dew, Bonaqua / Bonaqa and Kinley.

The Company competes with PepsiCo, Inc., Nestle, Dr Pepper Snapple Group, Inc., Groupe Danone, Kraft Foods Inc. and Unilever.

See Also

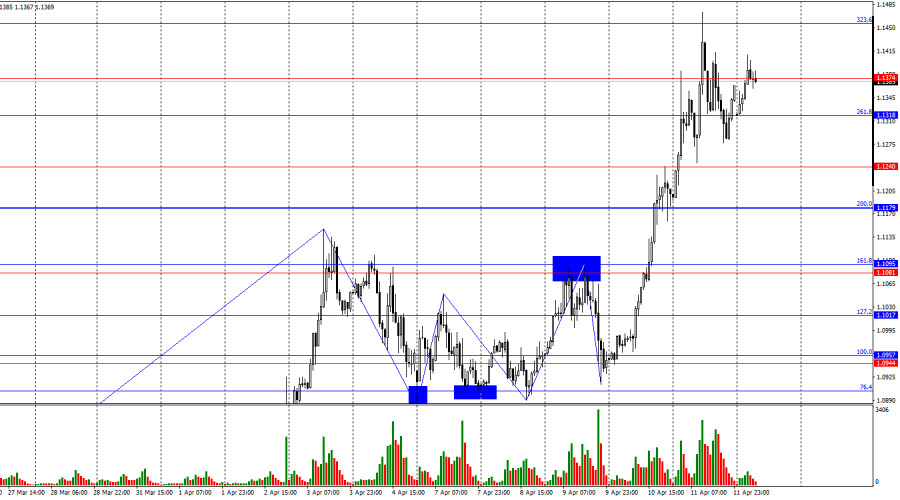

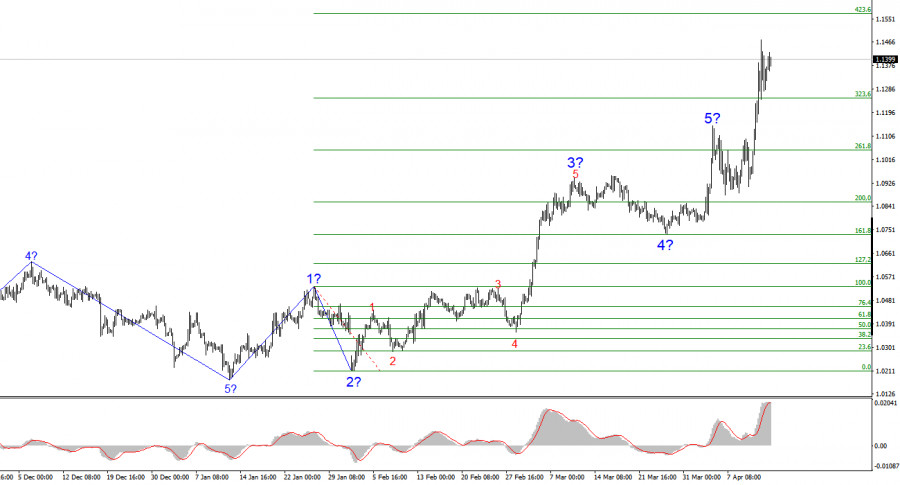

- Forecast for EUR/USD on April 14, 2025

Author: Samir Klishi

12:28 2025-04-14 UTC+2

1378

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14th

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14thAuthor: Isabel Clark

12:16 2025-04-14 UTC+2

1108

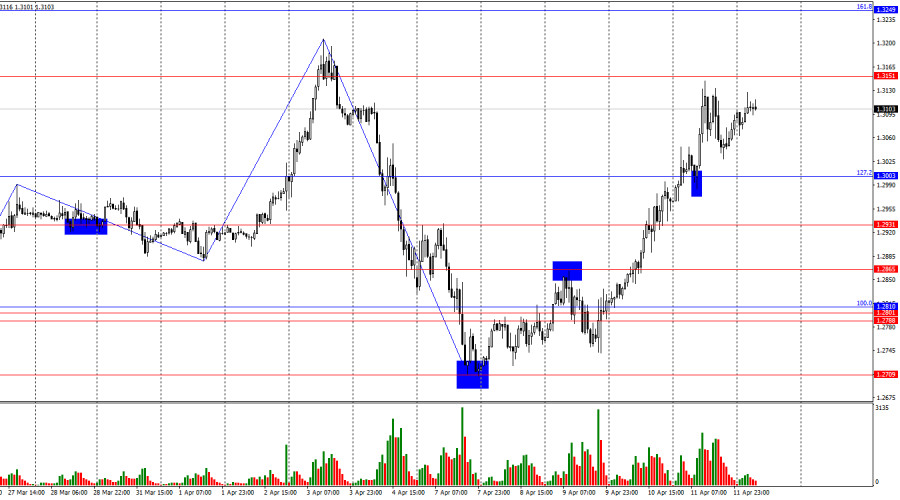

Forecast for GBP/USD on April 14, 2025Author: Samir Klishi

12:25 2025-04-14 UTC+2

1078

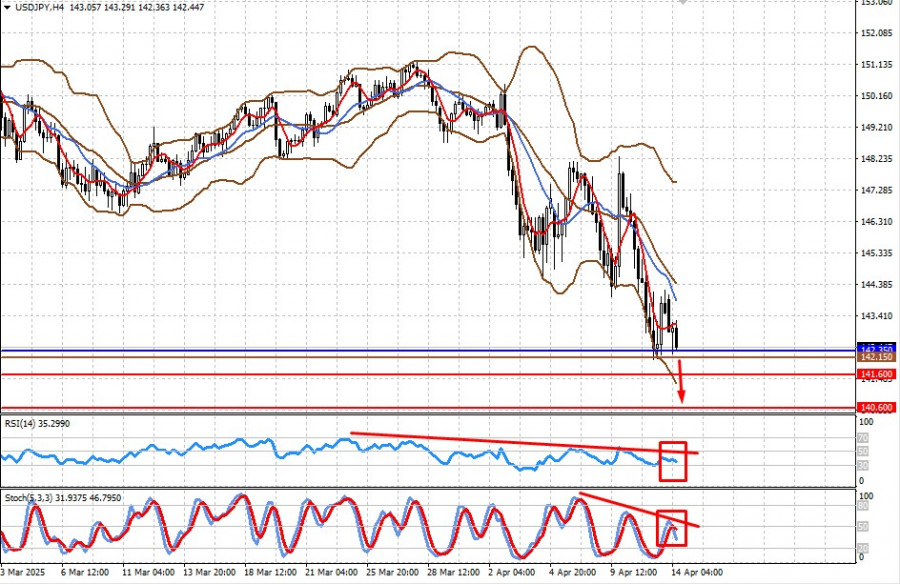

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

12:31 2025-04-14 UTC+2

1018

Fundamental analysisThe Uncertainty Factor Will Pressure the Dollar and Support Demand for Safe-Haven Assets (There is a likelihood of further decline in USD/JPY and rising gold prices)

Global markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic of tariff dutiesAuthor: Pati Gani

09:45 2025-04-14 UTC+2

1003

Recession fears prompt investors to sell the S&P 500 — but what if they're wrong?Author: Marek Petkovich

09:45 2025-04-14 UTC+2

913

- Global markets have been swept up in a tariff whirlwind, and the eye of the storm is once again in Washington. Trump, with a stroke of his pen, sends indices plunging or grants them a rebound, but behind the impressive numbers lies instability

Author: �lena Ivannitskaya

14:28 2025-04-14 UTC+2

898

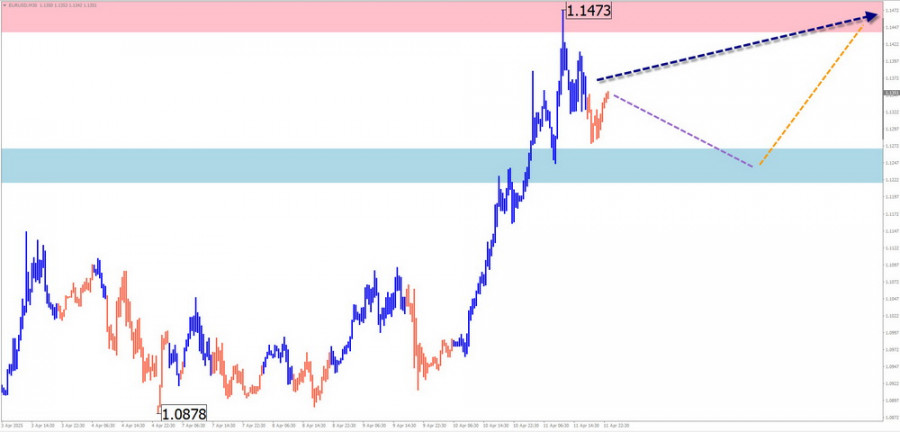

The EUR/USD pair gained another 100 basis points on MondayAuthor: Chin Zhao

19:05 2025-04-14 UTC+2

868

Technical analysisTrading Signals for GOLD (XAU/USD) for April 14-17, 2024: sell below $3,224 (+1/8 Murray - 21 SMA)

Our trading plan for the coming hours is to sell gold below 3,224, with targets at 3,203 and 3,156. We should be alert to any technical rebound, as the outlook remains bullish.Author: Dimitrios Zappas

15:59 2025-04-14 UTC+2

838

- Forecast for EUR/USD on April 14, 2025

Author: Samir Klishi

12:28 2025-04-14 UTC+2

1378

- Wave analysis

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14th

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and Gold – April 14thAuthor: Isabel Clark

12:16 2025-04-14 UTC+2

1108

- Forecast for GBP/USD on April 14, 2025

Author: Samir Klishi

12:25 2025-04-14 UTC+2

1078

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

12:31 2025-04-14 UTC+2

1018

- Fundamental analysis

The Uncertainty Factor Will Pressure the Dollar and Support Demand for Safe-Haven Assets (There is a likelihood of further decline in USD/JPY and rising gold prices)

Global markets remain heavily influenced by Donald Trump's erratic behavior. In his attempt to pull the U.S. out of severe economic dependence on imports, Trump continues to juggle the topic of tariff dutiesAuthor: Pati Gani

09:45 2025-04-14 UTC+2

1003

- Recession fears prompt investors to sell the S&P 500 — but what if they're wrong?

Author: Marek Petkovich

09:45 2025-04-14 UTC+2

913

- Global markets have been swept up in a tariff whirlwind, and the eye of the storm is once again in Washington. Trump, with a stroke of his pen, sends indices plunging or grants them a rebound, but behind the impressive numbers lies instability

Author: �lena Ivannitskaya

14:28 2025-04-14 UTC+2

898

- The EUR/USD pair gained another 100 basis points on Monday

Author: Chin Zhao

19:05 2025-04-14 UTC+2

868

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 14-17, 2024: sell below $3,224 (+1/8 Murray - 21 SMA)

Our trading plan for the coming hours is to sell gold below 3,224, with targets at 3,203 and 3,156. We should be alert to any technical rebound, as the outlook remains bullish.Author: Dimitrios Zappas

15:59 2025-04-14 UTC+2

838