Veja também

12.12.2022 09:53 AM

12.12.2022 09:53 AMEUR/USD

Analysis:

The September 26 incomplete wave algorithm determines the short-term trend of the major European currencies. The movement's overall level has now surpassed the D1 scale. After its breakout, the intermediate resistance became support. The quotes have been forming an imperfect interim correction over the past week.

Forecast:

The general sideways trend of euro price fluctuations is anticipated to continue in the early days of this week. Its second half is more likely to see an increase in volatility, a reversal, and a continuation of the price rise.

Potential zones for reversals

Resistance:

- 1.0760/1.0810

Support:

- 1.0450/1.0400

Recommendations:

Sales: are potentially unprofitable and have limited potential.

Purchases: Your vehicles may be suggested for trading transactions once the corresponding signals for those vehicles appear in the support zone.

USD/JPY

Analysis:

The imperfect algorithm of the descending stretched plane of the major pair of the Japanese yen determines the primary direction of intraday trends. The wave has reached its peak. The price breached a strong support level that had previously served as resistance.

Forecast:

The price of the pair anticipate mainly moving "sideways" along the predicted resistance over the coming few days. You can anticipate a reversal and a continuation of the bearish course closer to the weekend. The calculated support represents the lower bound of the expected weekly entry of the pair.

Potential zones for reversals

Resistance:

- 137.50/138.00

Support:

- 133.60/133.10

Recommendations:

Purchases may be made during different sessions. It is advised to purchase a fractional lot due to the low potential.

Sales: this will only be important once your vehicle's corresponding reversing signals appear in the resistance zone area.

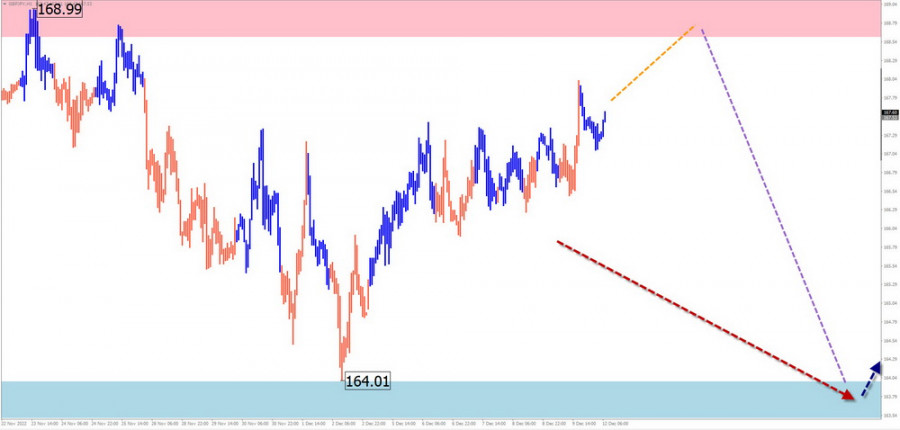

GBP/JPY

Analysis:

Since the end of September, the waves on the pair's chart between the British pound and the Japanese yen have been descending. The wave structure is still undergoing correction as a horizontal plane forms. There aren't any completion signals at the time of analysis.

Forecast:

The general lateral mood of the pair's fluctuations is anticipated to persist this week. When there is likely pressure on the resistance zone, you can watch for a change in course. Most likely, the decline stops at the calculated support.

Potential zones for reversals

Resistance:

- 168.60/169.10

Support:

- 164.00/163.50

Recommendations:

Small-lot purchases are possible during a single day. Lowering the trading lot is safer.

Sales: are available following the occurrence of verified reversal signals in the vicinity of the resistance zone.

USD/CAD

Analysis:

The Canadian dollar chart's most recent wave structure, which is useful for forecasting and trading, is directed downward and has been decrementing since September 26. In its structure, the middle part (B) is formed. After it is finished, part (C) will come next, bringing the wave's overall wave scale to the level of the reversal.

Forecast:

The upward movement is anticipated to continue at the start of this week, up to the limits of the calculated resistance. When a reversal forms and the downward course resumes, you can wait for it to happen.

Potential zones for reversals

Resistance:

- 1.3740/1.3790

Support:

- 1.3190/1.3140

Recommendations:

Purchases: are highly risky and could end up being unprofitable.

After the emergence of reversal signals in the vicinity of the resistance zone, sales may be advised.

NZD/USD

Short analysis

Since the end of September, an upward trend has been forming on the chart of the major New Zealand dollar pair. The price has reached a strong potential reversal zone over a broad timeframe. The wave structure's analysis suggests that quotations could increase to their maximum level.

Forecast for the coming week:

The likelihood of a sideways flat at the start of the upcoming week is very high. The price could move downward, but only as far as the support boundaries allow. The second half of the week should see the most activity and the start of price growth again.

Potential zones for reversals

Resistance:

- 0.6500/0.6550

Support:

- 0.6350/0.6300

Recommendations

Sales in the vicinity of the resistance zone should only be made once confirmed reversal signals have appeared.

Purchases: advised by a cut-down quantity from the support zone. The resistance zone restricts the potential.

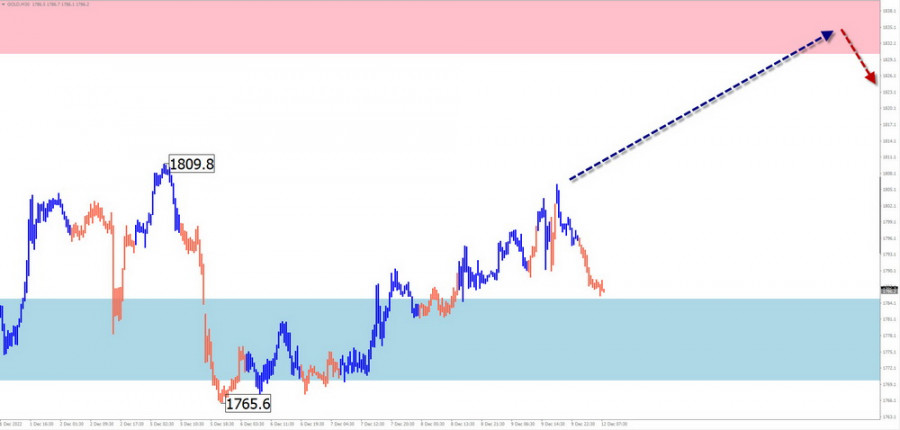

GOLD

Analysis:

A downward wave has been driving the trend in the gold market since March of this year. Gold prices have been correcting over the previous two months, forming the middle of the wave. The price is close to a significant resistance area at the time of analysis. The ascending section's structure needs to be completed.

Forecast:

The upward movement vector is anticipated to carry on this coming week until the resistance zone rise is fully completed. A brief decline in the support area is not ruled out over the next few days.

Potential zones for reversals

Resistance:

- 1830.0/1845.0

Support:

- 1785.0/1770.0

Recommendations:

There won't be any restrictions on sales in the upcoming days.

Purchases: Within the parameters of individual trading sessions, fractional lots may be purchased from the support zone.

Reasons: Each wave has three components in a simplified wave analysis (UVA). The final, incomplete wave is examined at each TF. The dotted line depicts the predicted movements.

Be aware that the wave algorithm needs to account for the instruments' temporal movement length!

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.