SEKJPY (Swedish Krona vs Japanese Yen). Exchange rate and online charts.

Currency converter

28 Mar 2025 23:47

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

SEK/JPY (Swedish Krona vs Japanese Yen)

The SEK/JPY currency pair is the cross rate against the U.S. dollar. There is no the U.S. dollar in this currency pair, nevertheless the greenback still affects it profoundly. To make it clear, just combine the USD/JPY and USD/SEK charts in the same price chart, and you will get the approximate SEK/JPY chart.

The Swedish krona and the Japanese yen are under the U.S. dollar enormous influence. Hence, for a more accurate prediction of the future rate of this currency pair, you should consider the key economic indicators of the economy of the United States. There are such indicators as the GDP, Producer Price Index (PPI), unemployment rate, trade balance and many others. Remember that the currencies listed above may respond in a different way to changes in the U.S. economic situation.

Sweden is one of the leading countries in the world that outclasses the other Nordic countries like Denmark, Norway, and Finland. The high economic development of this country is provided by the large mineral reserves, timber, and hydropower resources as well as the highly qualified specialists in all economic fields.

Besides, Sweden is one of world's leading manufacturers of engineering products, as well as the largest supplier of iron ore, steel, and paper. The majority of the Swedish products is sold abroad. That means that the export volumes may not only strengthen the economy, but also weaken it. Moreover, Sweden is deeply dependent on world prices on energy resources such as oil and gas that may provoke problems in the national economy in general and as a result the Swedish krona fluctuations.

SEK/JPY is extremely vulnerable to the change in the world's political or economic situation. Therefore, it is hard to predict movement of this currency pair, because its trend usually differs any analysis.

The beginning traders would better not to start their trading activity on Forex by dealing with this currency pair. That fact is that there are a lot nuances of the price chart behavior that can make an impact on the future rate.

Comparing to the major currency pairs such as EUR/USD, USD/CHF, GBP/USD, and USD/JPY, this one is relatively illiquid. That is why, when you make a forecast of the future movement of this financial instrument, you should primarily focus on those currency pairs that consist of the Swedish krona and the Japanese yen in tandem with the U.S. dollar.

Pay attention to the spread for the cross rates that is usually higher than for more popular currency pairs. So before you start working with cross currency pairs, read and understand the broker's conditions for this specified trade instrument.

See Also

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

928

Donald Trump is not the only one to blame for the S&P 500's decline.Author: Marek Petkovich

09:19 2025-03-28 UTC+2

838

Bears are trying to break through the bulls' defensesAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

838

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

823

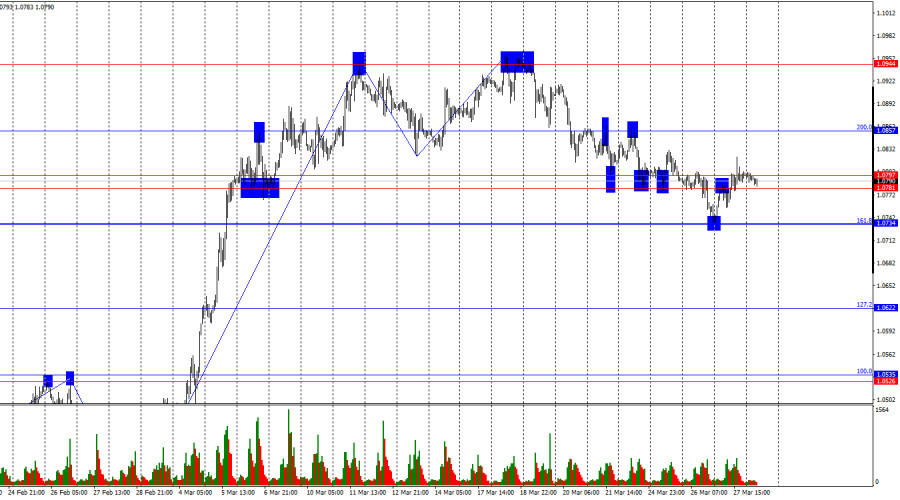

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

793

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

793

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

793

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

763

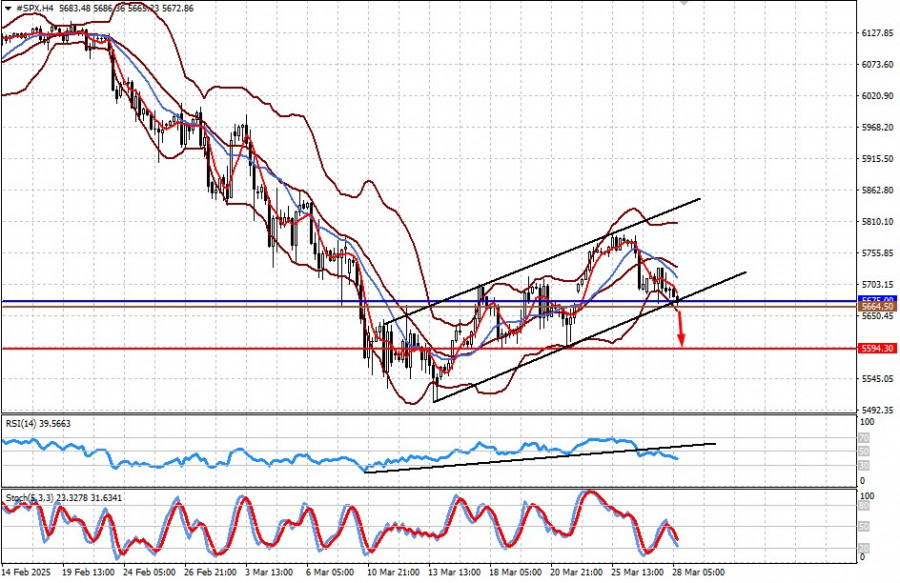

Fundamental analysisMarkets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

748

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

928

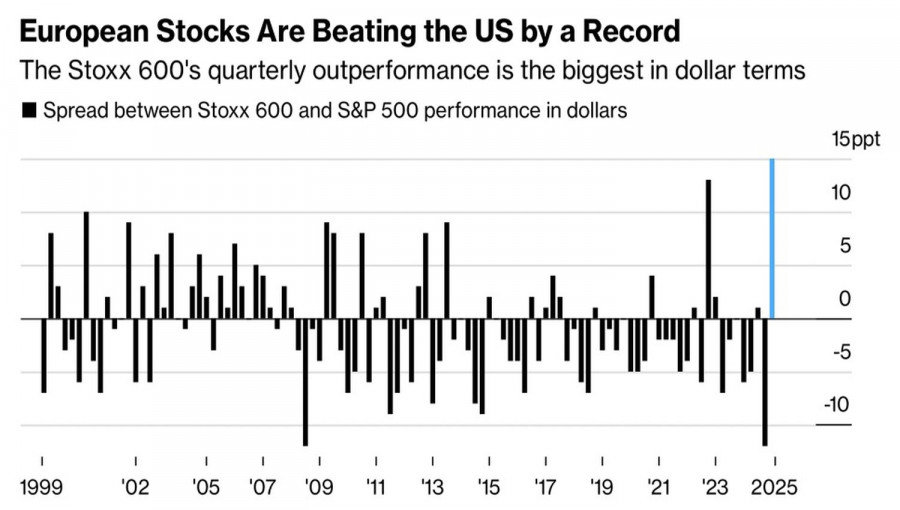

- Donald Trump is not the only one to blame for the S&P 500's decline.

Author: Marek Petkovich

09:19 2025-03-28 UTC+2

838

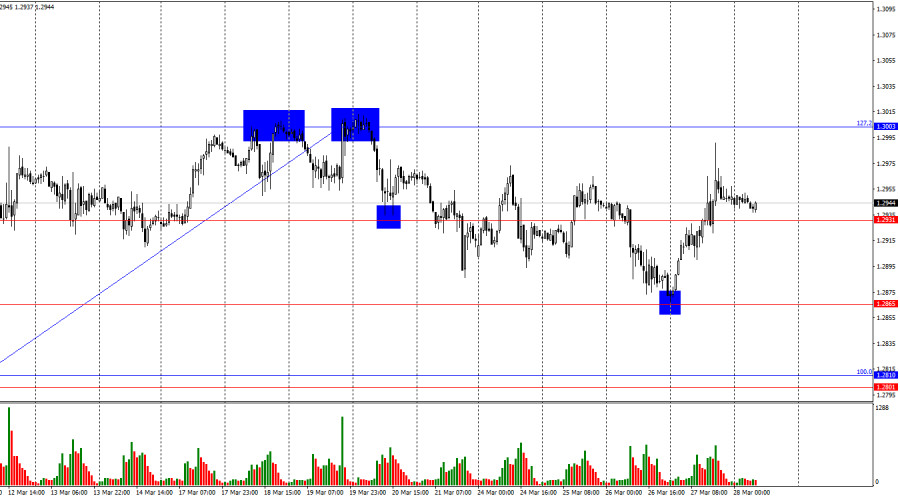

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

838

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

823

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

793

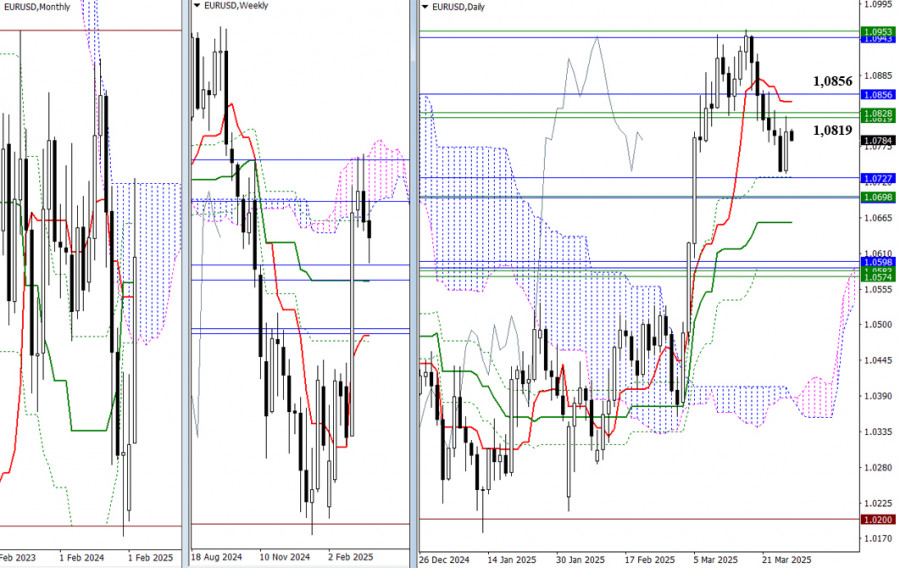

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

793

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

793

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

763

- Fundamental analysis

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

748