یہ بھی دیکھیں

Today at 3:00 AM London time, the Bank of Japan is expected to raise the interest rate from 0.25% to 0.50%. The accompanying press conference is scheduled for 9:30 AM, and the comments made during this event are likely to significantly influence market movements.

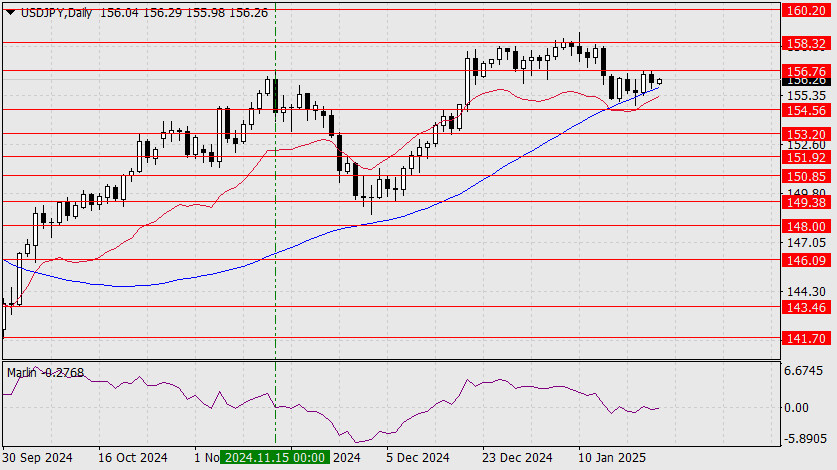

The current technical situation continues to support the primary scenario discussed over the past two weeks: the USD/JPY pair is anticipated to break through the MACD line on the daily timeframe, targeting lower levels at 154.56, 153.20, and 151.92. These levels have been adjusted to reflect yesterday's high of 156.76, the highest point since November 15. The Marlin oscillator is consolidating below the zero line, indicating a readiness for a downward movement.

An alternative scenario could emerge if the price breaks above the resistance level of 160.20.

On the four-hour chart, the price is awaiting news from the central bank, currently trading between the MACD line (at 155.60) and the resistance level of 156.76. A drop below the MACD line would suggest further downward movement. Additionally, the Marlin oscillator is positioned favorably for a downward breakout, as it is near the neutral line and likely to align with a signal from the MACD line. We are looking for a definitive signal from the BOJ to confirm the next move.

You have already liked this post today

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.