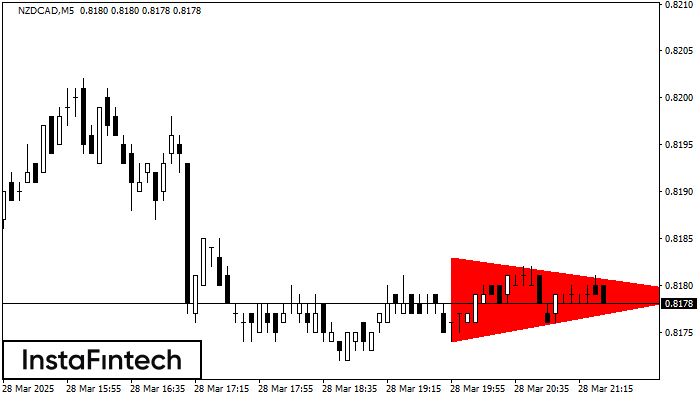

Bearish Symmetrical Triangle

was formed on 28.03 at 21:34:03 (UTC+0)

signal strength 1 of 5

According to the chart of M5, NZDCAD formed the Bearish Symmetrical Triangle pattern. This pattern signals a further downward trend in case the lower border 0.8174 is breached. Here, a hypothetical profit will equal the width of the available pattern that is -9 pips.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength