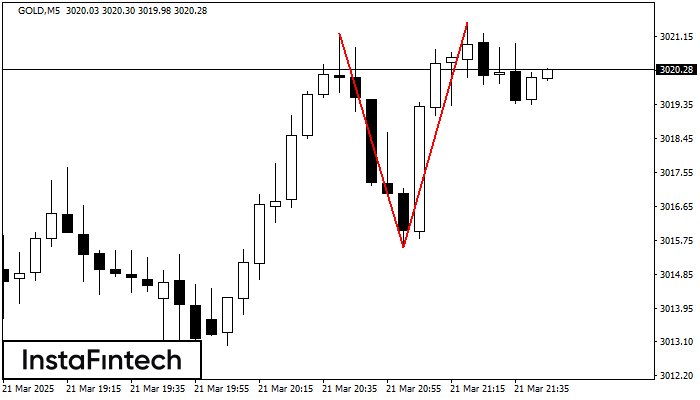

Double Top

was formed on 21.03 at 21:45:05 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on GOLD M5. Characteristics: the upper boundary 3021.21; the lower boundary 3015.56; the width of the pattern is 594 points. Sell trades are better to be opened below the lower boundary 3015.56 with a possible movements towards the 3015.41 level.

The M5 and M15 time frames may have more false entry points.

- All

- All

- Bearish Rectangle

- Bearish Symmetrical Triangle

- Bearish Symmetrical Triangle

- Bullish Rectangle

- Double Top

- Double Top

- Triple Bottom

- Triple Bottom

- Triple Top

- Triple Top

- All

- All

- Buy

- Sale

- All

- 1

- 2

- 3

- 4

- 5

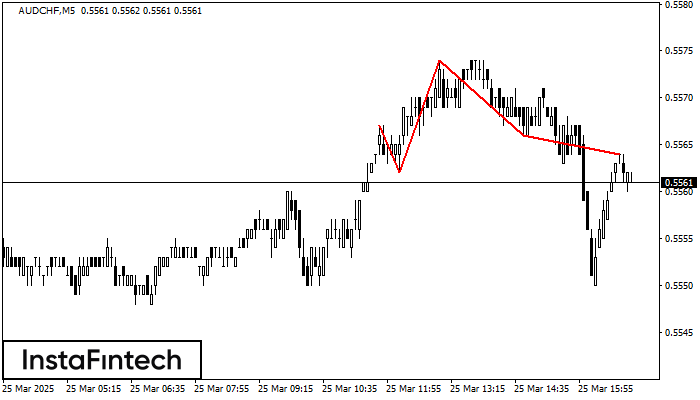

Head and Shoulders

was formed on 25.03 at 17:01:08 (UTC+0)

signal strength 1 of 5

The technical pattern called Head and Shoulders has appeared on the chart of AUDCHF M5. There are weighty reasons to suggest that the price will surpass the Neckline 0.5562/0.5566 after

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

Bullish pennant

was formed on 25.03 at 17:00:12 (UTC+0)

signal strength 2 of 5

The Bullish pennant graphic pattern has formed on the #AAPL M15 instrument. This pattern type falls under the category of continuation patterns. In this case, if the quote can breaks

The M5 and M15 time frames may have more false entry points.

Open chart in a new window

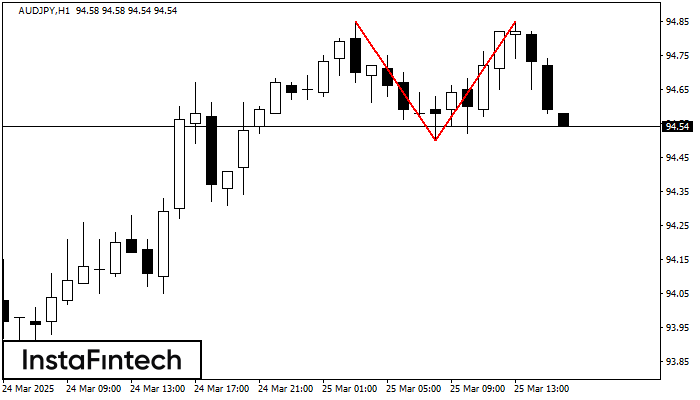

Double Top

was formed on 25.03 at 16:00:35 (UTC+0)

signal strength 4 of 5

The Double Top pattern has been formed on AUDJPY H1. It signals that the trend has been changed from upwards to downwards. Probably, if the base of the pattern 94.50

Open chart in a new window