Lihat juga

28.03.2025 11:45 AM

28.03.2025 11:45 AMToday, the EUR/USD pair is consolidating near the key psychological level of 1.0800, showing no intention of retreating below 1.0780 as traders and investors await the release of the U.S. PCE (Personal Consumption Expenditures) Price Index.

This data will be closely watched for clues on the Federal Reserve's next steps, which are expected to significantly influence the dollar's short-term dynamics and potentially give new momentum to the EUR/USD pair.

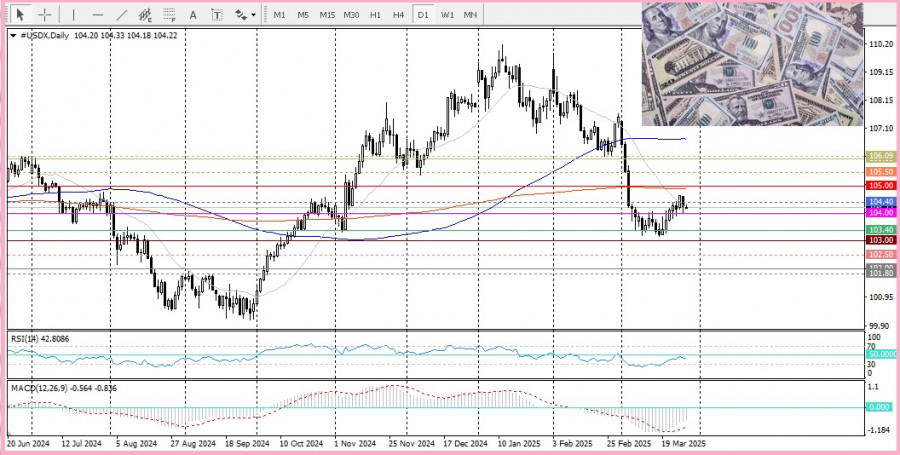

Recent developments, including the introduction of 25% tariffs on imported cars and light trucks by U.S. President Donald Trump, along with duties on all steel and aluminum, have created market uncertainty and contributed to the weakening of the U.S. Dollar Index. This, in turn, is supporting the EUR/USD pair, especially in light of the Fed's forecasts for interest rate cuts. At the same time, a slight trade shift is preventing the dollar from extending its retreat from multi-week highs, limiting EUR/USD's upward potential.

Nevertheless, a significant strengthening of the U.S. dollar appears unlikely for now, amid concerns that Trump's aggressive trade policies could slow U.S. economic growth, potentially forcing the Fed to resume rate cuts soon. Markets have already priced in the likelihood of the Federal Reserve lowering borrowing costs at its monetary policy meetings in June, July, and October. This has kept dollar bulls on the defensive, helping to contain downside pressure on EUR/USD.

It is also worth noting that the EU is preparing retaliatory measures in response to U.S. tariffs, which could further escalate trade tensions and raise the risk of a trade war between the EU and the U.S., adding more pressure on the EUR/USD pair.

From a technical perspective, if the pair holds above the 1.0780 level, it could open the door to further gains. However, the 1.0725 level or the 200-day SMA remains key support, and a break below it would likely lead to additional selling. Still, with oscillators on the daily chart holding firmly in positive territory, the path of least resistance remains to the upside—especially if prices break through the 1.0800 mark.

The current situation calls for close monitoring, particularly in light of upcoming economic data and speeches from FOMC members.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Euro sedang menunjukkan kenaikan yang mendadak berbanding dolar AS. Pasangan EUR/USD telah mencapai paras tertinggi dalam tiga tahun dan tidak menunjukkan tanda-tanda akan memperlahan. Sementara itu, menurut kaji selidik pakar

Pada hari Khamis, pelabur menyedari bahawa kestabilan tidak wujud pada masa ini. Volatiliti pasaran yang tinggi kekal dan akan terus mendominasi untuk suatu tempoh masa. Penyebab utama keadaan ini adalah

Beberapa peristiwa makroekonomi dijadualkan pada hari Jumaat, tetapi tiada satu pun yang dijangka akan memberi kesan kepada pasaran. Sudah tentu, kita mungkin melihat reaksi jangka pendek terhadap laporan individu, tetapi

Pasangan mata wang GBP/USD turut diniagakan lebih tinggi pada hari Khamis. Sebagai peringatan, faktor makroekonomi dan asas tradisional ketika ini hampir tidak memberikan sebarang pengaruh terhadap pergerakan mata wang. Satu-satunya

Pasangan mata wang EUR/USD merosot dengan ketara pada malam Rabu tetapi menunjukkan sedikit pemulihan pada siang hari. Pada hari Khamis, terdapat pertumbuhan seterusnya—siri turun naik ini hanya boleh digambarkan sebagai

Pertukaran mata wang GBP/USD juga menunjukkan pertumbuhan yang kuat pada hari Khamis, walaupun tidak sekuat pasangan EUR/USD. Pound meningkat hanya sekitar 200 pip—yang mana bukan pergerakan yang besar dalam keadaan

Laporan CPI yang dikeluarkan pada hari Khamis menunjukkan inflasi yang lebih lemah daripada dijangka. Pasaran bertindak balas dengan sewajarnya: dolar A.S. mengalami tekanan baru (Indeks Dolar A.S. jatuh ke dalam

Hari ini, emas mengekalkan nada positif dan didagangkan di atas paras $3100. Kebimbangan terhadap peningkatan ketegangan dalam perang dagangan antara Amerika Syarikat dan China, serta kegusaran terhadap kemungkinan kelembapan ekonomi

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.