Lihat juga

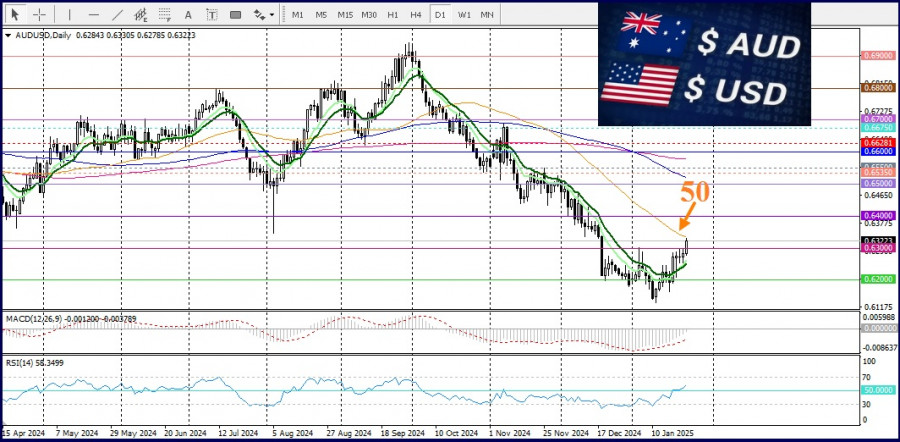

The AUD/USD pair has broken out of its two-day trading range, reaching a new monthly high. Spot prices are displaying positive momentum, pushing beyond the 50-day Simple Moving Average (SMA) and positioning for further gains amid U.S. dollar weakness.

The U.S. Dollar Index, which tracks the greenback against a basket of currencies, is falling to a new monthly low on expectations that the Federal Reserve will cut interest rates by the end of the year.

These expectations have been bolstered by comments from U.S. President Donald Trump, who called for immediate rate cuts. Combined with overall market optimism, this has weakened the dollar's safe-haven status and supported the rally in AUD/USD.

Global risk sentiment received an additional boost after Trump stated his preference for avoiding tariffs on China and highlighted the possibility of reaching a trade agreement. These remarks have eased inflationary concerns and contributed to a decline in U.S. Treasury yields, further pressuring the dollar. Additionally, technical buying above the 0.6300 level has driven the intraday rise in AUD/USD. The Relative Strength Index (RSI) has confidently crossed the 50-level on the daily chart in a positive direction, while the 9-day Exponential Moving Average (EMA) has moved above the 14-day EMA, further signaling potential for continued growth.

With the recent gains, spot prices have risen by approximately 200 points from the lowest levels reached earlier this month and are on track to break a three-week losing streak.

For better trading opportunities today, attention should focus on the release of preliminary U.S. PMI data, which could provide additional momentum during the early North American session. Moving into next week, Monday's official Chinese PMI figures will be key to influencing sentiment regarding the Australian dollar, a currency closely tied to China's economic performance.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.