Lihat juga

04.04.2024 02:38 PM

04.04.2024 02:38 PMOn Thursday, the market observes somewhat contradictory dynamics of the dollar. It weakens in the DXY index, which primarily consists of the euro, but strengthens against safe-haven assets—the yen, franc, and gold.

At the same time, market participants who are in active short positions on the dollar may want to pay attention to the dynamics of U.S. government bond yields, which continue to rise.

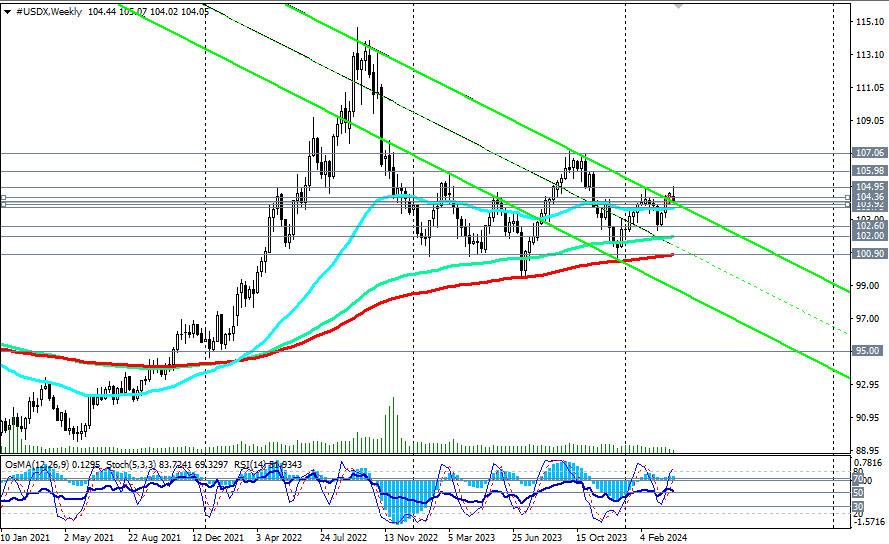

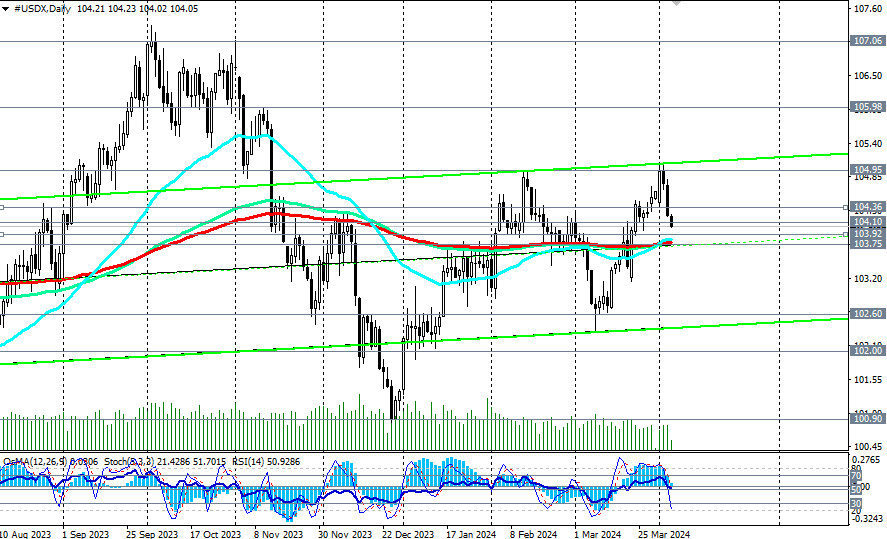

From a technical point of view, the dollar index (CFD #USDX in the MT4 terminal) remains in a bullish market zone, medium-term—above the support level of 103.75 (200 EMA on the daily chart), long-term—above the key support level of 100.90 (200 EMA on the weekly chart).

Therefore, long positions on the dollar index remain preferable for now.

A signal for new purchases could be the breakout of the important short-term resistance level of 104.36 (200 EMA on the 1-hour chart).

In case of a decrease to the support levels of 103.92 (200 EMA on the 4-hour chart) and 103.75 (200 EMA, 144 EMA on the daily chart), it is possible to place pending limit orders for purchase with stops below the 103.60 mark.

In an alternative scenario, after the confirmed breakout of the support level at 103.75, the price may deepen into the downward channel on the weekly chart, with targets at support levels of 102.60 and 102.00 (144 EMA on the weekly chart).

The breakout of the key support level of 100.90 (200 EMA on the weekly chart) will bring the DXY into the long-term bear market zone. The bullish trend of the dollar will be broken.

This scenario may gain momentum if tomorrow's U.S. Labor Department report turns out to be significantly weaker than forecasted. Further dynamics of the dollar and its DXY index will largely depend on the fundamental background and the actions of the Federal Reserve.

Support levels: 104.10, 104.00, 103.92, 103.75, 103.00, 102.60, 102.00, 101.00, 100.90, 100.00

Resistance levels: 104.36, 104.95, 105.00, 106.00, 106.80, 107.00, 107.30

Trading Scenarios

Main scenario: BuyStop 104.40. Stop-Loss 103.60. Targets 104.95, 105.00, 106.00, 106.80, 107.00, 107.30

Alternative scenario: SellStop 103.60. Stop-Loss 104.10. Targets 103.00, 102.60, 102.00, 101.00, 100.90, 100.00

"Targets" correspond to support/resistance levels. This also does not mean that they will necessarily be reached, but they can serve as a guideline for planning and placing your trading positions.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Sepanjang hari Selasa, pasangan GBP/USD terus bergerak ke atas. Seperti yang kita lihat, mata wang British tidak memerlukan alasan khusus untuk terus meningkat. Kami telah berkata beberapa kali bahawa terdapat

Analisis Dagangan Hari Selasa Carta 1 Jam pasangan EUR/USD Pada hari Selasa, pasangan mata wang EUR/USD mengalami sedikit pembetulan, yang boleh dianggap sebagai pembetulan teknikal semata-mata. Semalam — dan secara

Analisis EUR/USD carta 5-Minit Pasangan mata wang EUR/USD mula menunjukkan penurunan yang telah lama dinantikan pada hari Selasa, walaupun kejatuhan tersebut tidak terlalu ketara mahupun berpanjangan. Perlu ditegaskan bahawa tiada

Pada hari Selasa, pasangan mata wang GBP/USD meneruskan pergerakan menaik untuk sebahagian besar hari. Tiada alasan penting atau asas yang kukuh untuk ini, namun seluruh pasaran mata wang bergerak secara

Dalam ramalan pagi saya, saya memfokuskan pada tahap 1.3204 dan merancang untuk membuat keputusan perdagangan daripadanya. Mari kita lihat carta 5 minit dan lihat apa yang berlaku. Penembusan pada tahap1.3204

Dalam ramalan pagi ini, saya telah menonjolkan tahap 1.1377 dan bercadang untuk membuat keputusan dagangan dari situ. Mari kita lihat carta 5 minit dan pecahkan apa yang telah berlaku. Kenaikan

Pada hari Isnin, pasangan GBP/USD meneruskan pergerakan menaiknya tanpa sebarang masalah. Tidak ada alasan makroekonomi untuk ini, malah euro menunjukkan pergerakan yang lebih perlahan menjelang akhir hari tersebut. Walau bagaimanapun

Analisis Dagangan Hari Isnin Carta 1 Jam pasangan EUR/USD Pada hari Isnin, pasangan mata wang EUR/USD didagangkan lebih kepada pergerakan mendatar berbanding kenaikan, walaupun nilainya masih mencatat peningkatan menjelang penghujung

Analisis 5-Minit pasangan GBP/USD Pasangan mata wang GBP/USD diniagakan lebih tinggi pada hari Isnin tanpa sebarang "tetapi". Walaupun euro menunjukkan sedikit kenaikan menjelang penghujung hari, pergerakannya tidak signifikan — sebaliknya

Pasangan mata wang EUR/USD cuba untuk melanjutkan pertumbuhannya semasa sesi Isnin tetapi akhirnya mengalami penurunan pada separuh kedua hari tersebut. Pada dasarnya, kita tidak melihat sebarang keuntungan ketara untuk dolar

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.