Lihat juga

22.07.2023 11:38 PM

22.07.2023 11:38 PMWeekly review :

Bullish outlook:

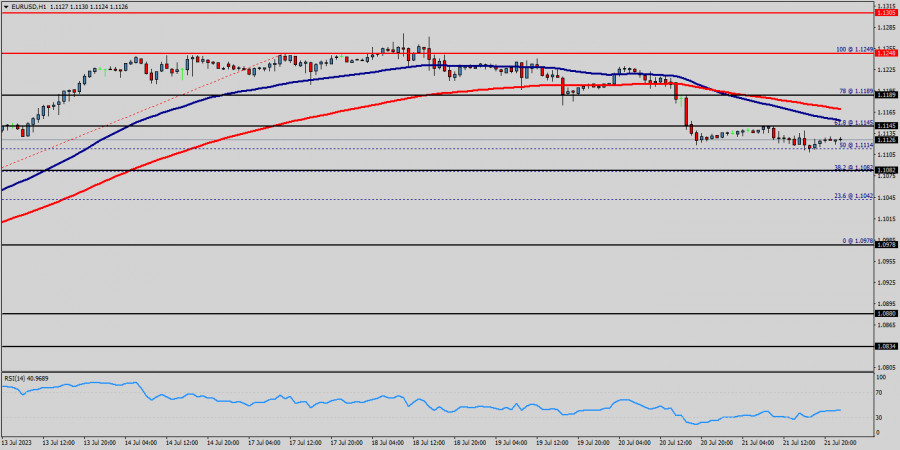

The EUR/USD pair broke resistance which turned to strong support at the level of 1.1141. The level of 1.1141 coincides with 61.8% of Fibonacci, which is expected to act as major support. Since the trend is above the 61.8% Fibonacci level, the market is still in an uptrend. From this point, the EUR/USD pair is continuing in a bullish trend from the new support of 1.1141.

The RSI starts signaling an upward trend, as the trend is still showing strength above the moving average (100) and (50). Thus, the market is indicating a bullish opportunity below 1.1141. Currently, the price is in a bullish channel. According to the previous events, we expect the EUR/USD pair to move between 1.1141 and 1.1300.

On the H1 chart, resistance is seen at the levels of 1.1250 and 1.1300. Also, it should be noticed that, the level of 1.1141 represents the daily pivot point. Therefore, strong support will be formed at the level of 1.1141 providing a clear signal to buy with the targets seen at 1.1250.

If the trend breaks the support at 1.1241 (first resistance) the pair will move upwards continuing the development of the bullish trend to the level 1.1300 in order to test the daily resistance 2. However, stop loss is to be placed below the level of 1.1141.

Bearish outlook:

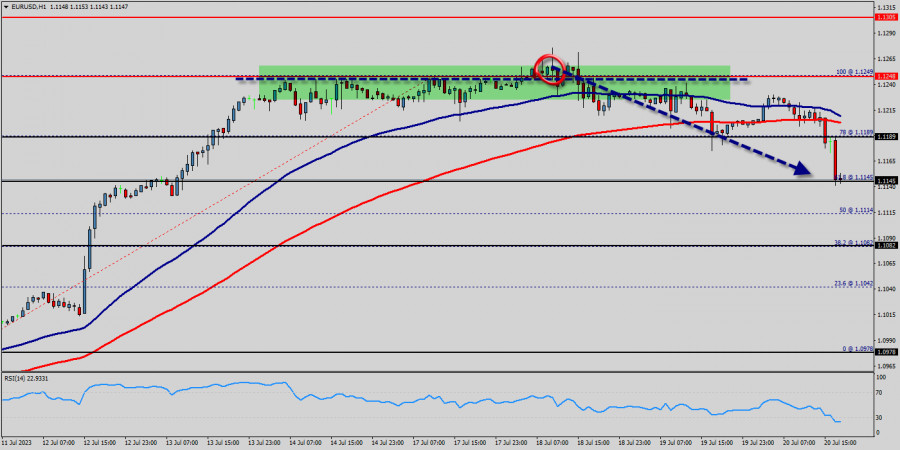

On the downside, 1.1189 (20-period Simple Moving Average (SMA), psychological level) aligns as first support ahead of 1.1189 (upper-limit of the ascending regression channel). Close below the latter could open the door for an extended slide toward 1.1000 (1 USD)(psychological level, mid-point of the ascending channel).

In the Eurozone, inflation has decreased to a half year low of 4% in July, but the core rate remained significantly above the ECB's target of 1%. Currently, interest rates in the bloc stand at 2%. However, pricing in derivatives markets suggests that traders anticipate rates peaking at just below 43% by year-end. The EUR/USD pair develops far above all its moving averages, with the 20 Simple Moving Average (SMA) accelerating north above the longer ones.

The mentioned SMA stands below the 1.1000 threshold, reflecting buyers' strength. At the same time, the Momentum indicator turned marginally lower but remains well above its midline, while the Relative Strength Index (RSI) indicator consolidates around 50. The Relative Strength Index (RSI) indicator on the one-hour chart stays in the overbought territory above 50 for the third straight trading day on Monday, suggesting that the pair could struggle to gather bullish momentum. The EUR/USD pair rose from the level of 1.1189 to top at 1.1248.

The EUR/USD pair has faced strong support at the level of 1.1189. So, the strong support has been already faced at the level of 1.1189 and the pair is likely to try to approach it in order to test it again and form a double bottom. Hence, the EUR/USD pair is continuing to trade in a bullish trend from the new support level of 1.1189; to form a bullish channel.

According to the previous events, we expect the pair to move between 1.1189 and 1.1354. Also, it should be noted major resistance is seen at 1.1354, while immediate resistance is found at 1.1300. Then, we may anticipate potential testing of 1.1354 to take place soon.

Moreover, if the pair succeeds in passing through the level of 1.1248 , the market will indicate a bullish opportunity above the level of 1.1248. A breakout of that target will move the pair further upwards to 1.1354. On the other hand, if the EUR/USD pair fails to break out through the support level of 1.1145; the market will decline further to the level of 1.1000 (daily support 2).

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Ujian harga 1.2672 berlaku apabila penunjuk MACD baru sahaja mula meningkat dari tanda sifar, yang mengesahkan titik masuk yang betul untuk membeli pound. Akibatnya, pasangan GBP/USD naik lebih dari

Analisis transaksi dan tip dagangan untuk pasangan mata wang GBP/USD Penurunan selanjutnya menjadi terhad kerana ujian harga 1.2477 berlaku sewaktu garis MACD bergerak turun dengan agak mendadak dari sifar. Pembelian

Pasangan mata wang ini diniagakan di atas semua Purata Bergerak (MA)(100) dan (50), dengan yang lebih pendek mendapat traksi ke atas tepat di bawah 50 Purata Bergerak Ringkas(SMA). Pasangan mata

Pound British melonjak melebihi 1.2843 untuk kali pertama dalam setahun pada sesi Asia hari Rabu, mencapai paras tertinggi selama lima belas bulan sebelum menyerah sedikit keuntungan, berikutan daripada pelabur yakin

Euro membuat percubaan penurunna harga susulan berita ekonomi AS yang negatif pada awal minggu dan mencapai paras rendah mingguan baharu. Walau bagaimanapun, di sana, euro menemui pembeli dan juga menandakan

Memandangkan kedua-dua pasaran menyaksikan pembetulan ketara, euro sekali lagi menunjukkan hubungan kukuh dengan pasaran saham AS. Pasaran AS jatuh disebabkan kebimbangan baharu mengenai bank kecil dan sederhana, manakala euro merosot

Pasangan EUR/USD, carta 4 jam Berita AS diterbitkan: Tuntutan pengangguran untuk minggu berakhir 25 Mac berjumlah 198,000, naik 7,000 daripada tempoh sebelumnya. Tuntutan berterusan, yang ketinggalan seminggu di belakang, meningkat

Pasangan mata wang EUR/USD Apakah yang diperkatakan oleh Fed semasa menaikkan kadar? Angka terkini menunjukkan pertumbuhan sederhana dalam perbelanjaan dan pengeluaran. Dalam tempoh beberapa bulan kebelakangan ini, pertumbuhan pekerjaan telah

Pasangan mata wang EUR/USD Euro melonjak naik meskipun terdapat jangkaan kenaikan kadar Fed. Sebilangan besar mengharapkan penurunan harga kerana Pengerusi Fed Jerome Powell menegaskan pendirian yang "hawkish", bercakap tentang hasrat

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.