यह भी देखें

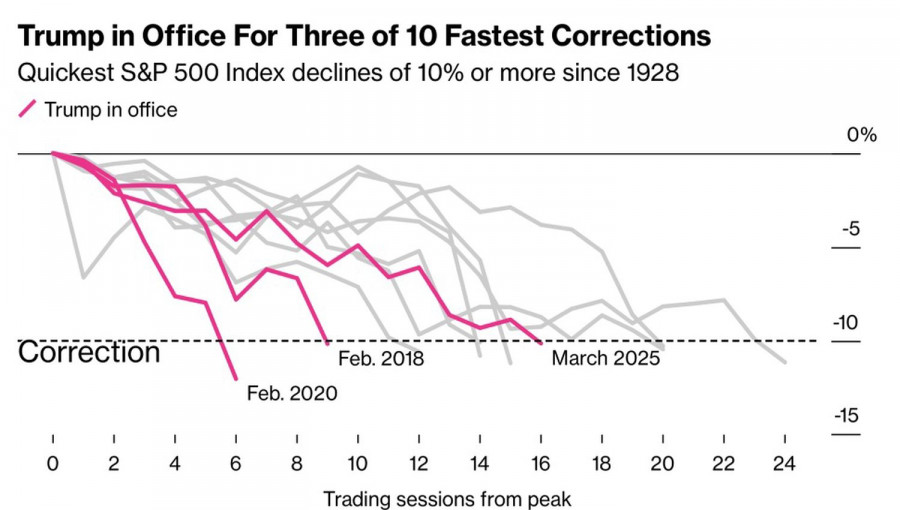

Anything can happen sooner or later. The S&P 500 entered correction territory in just 16 trading sessions. In the previous 24 instances where stocks dropped 10% from recent record highs but avoided a bear market, it took around eight months to recover to all-time highs. This suggests that the broad stock index is unlikely to regain its uptrend before mid-October.

S&P 500 correction trends

The euphoria that dominated the stock market during the presidential elections in November has now been replaced by pessimism. Investors have realized that events are unfolding differently than they had anticipated. They had envisioned Trump 2.0 as a continuation of Trump 1.0—just like eight years ago, they expected the White House leader to start with tax cuts and deregulation, giving the US economy a boost before pushing it over the edge with tariffs.

In reality, things turned out differently. Import tariffs are not just a negotiation tactic for the Republican leader—he is genuinely committed to bringing factories and production back to the US. This overhaul of a decades-old system is spooking investors, causing them to flee like rats from a sinking ship. As a result, the S&P 500 is not just declining—it is also losing ground to its European and global counterparts.

Economic policy uncertainty is at extreme levels, and markets are questioning whether they can withstand the April 2nd shock when mutual tariffs and import duties on specific industries are set to be announced.

Catching a falling knife?

Should investors buy in a bear market under these conditions? According to surveys by the American Association of Individual Investors (AAII), the proportion of stock market bears has surpassed the number of bulls for the first time in a long while. Financial advisors are unanimously recommending selling equities. Pessimism is extreme, and historically, such moments create perfect buying opportunities. However, now might not be the ideal time, as big players don't seem as scared as the retail investors.

US stock market bull vs. bear sentiment trends

The S&P 500 downtrend poses a risk to the US economy. A Harvard University study suggests that a 20% drop in the broad stock index in 2025 could reduce GDP growth by 1 percentage point. The reason? The top 10% of wealthy American households account for half of all consumer spending. When market capitalization falls, their wealth declines, leading to sluggish spending.

Treasury Secretary Scott Bessent derines the stock market correction as "normal" and insists that stock indices will thrive due to strong tax policies and deregulation in the long run, but for now, they remain stuck in a downward spiral.

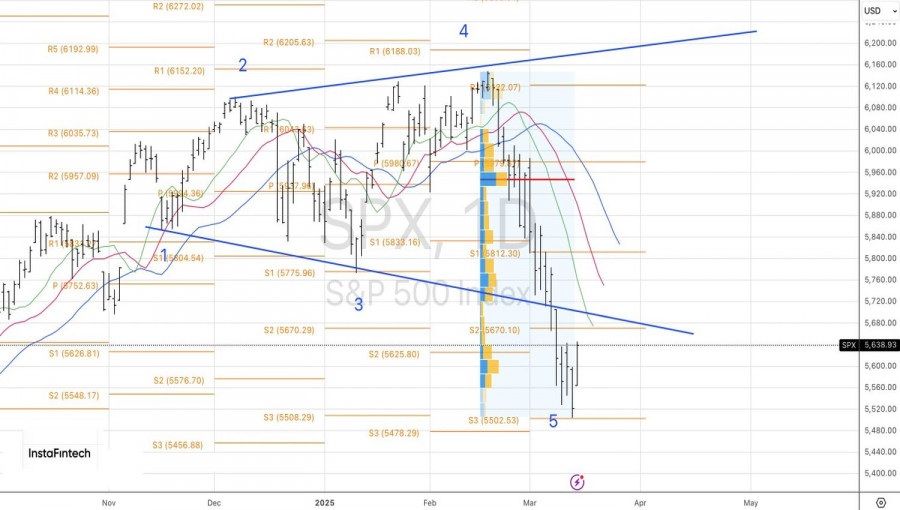

Technical outlook for the S&P 500

On the daily chart, a cluster has formed near the point 5 of the Expanding Wedge pattern. A break above 5,645 would serve as a buy signal for the S&P 500, but short-term gains are likely to be met with selling pressure at resistance levels of 5,670, 5,750, and 5,815.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

ईमेल/एसएमएस संबंधी

अधिसूचनाएँ

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.