Lihat juga

02.04.2025 08:50 AM

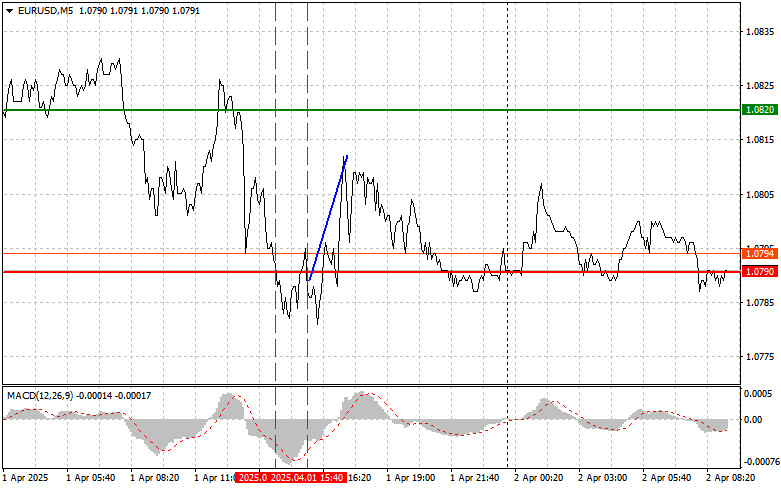

02.04.2025 08:50 AMThe price test at 1.0790 occurred when the MACD indicator had already moved significantly below the zero mark, which limited the pair's downside potential. For that reason, I did not sell the euro. A second test of 1.0790, with the MACD in the oversold zone, triggered Scenario #2 for buying the euro, which resulted in a 20-pip rise in the pair.

The euro did not react to yesterday's data on slowing inflation in the eurozone—neither rising nor falling—and remained within its current trading range. The published data showed that the core Consumer Price Index declined to 2.4% from 2.6%, outperforming analyst forecasts. Market participants chose to wait for further European Central Bank commentary on the matter to gain more clarity about the future of monetary policy.

No major macroeconomic releases are scheduled for the eurozone this morning, suggesting moderate trading activity. Investor attention will shift to the U.S. employment data and potential statements from Trump regarding tariffs, which could sharply increase pressure on risk assets, including the euro—so be prepared.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

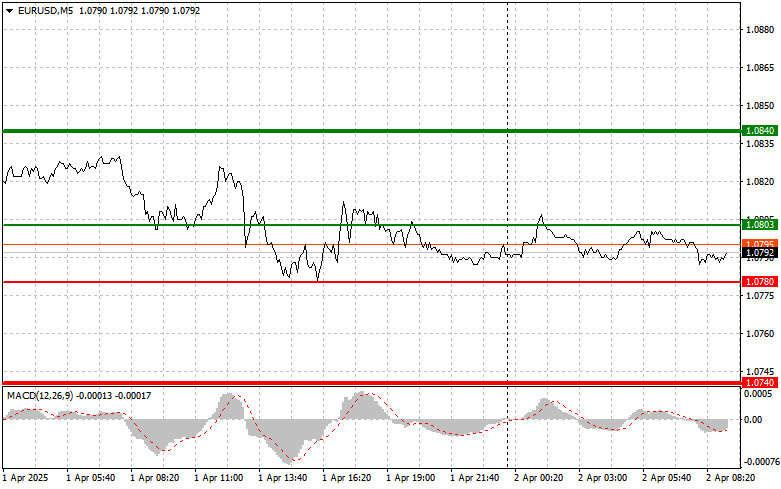

Scenario #1: I plan to buy the euro today at 1.0803 (green line on the chart), targeting a rise to 1.0840. At 1.0840, I plan to exit long positions and open short positions in the opposite direction, aiming for a 30–35 pip move from the entry. A bullish move in the euro in the first half of the day can only be expected as a minor correction. Important: Before buying, ensure that the MACD is above the zero line and beginning to rise.

Scenario #2: I will also consider buying the euro if there are two consecutive tests of 1.0780, with the MACD in oversold territory. This would limit the pair's downside potential and likely trigger a bullish reversal. Expect a rise toward 1.0803 and 1.0840.

Scenario #1: I plan to sell the euro after it reaches 1.0780 (red line on the chart), targeting a drop to 1.0740, where I will close short positions and enter long positions (expecting a 20–25 pip rebound). Pressure on the pair may return if there are unexpected tariff-related developments. Important: Before selling, ensure that the MACD is below the zero line and starting to decline.

Scenario #2: I will also consider selling the euro after two consecutive tests of 1.0803, provided the MACD is in the overbought zone. This would limit the pair's upside potential and trigger a bearish reversal. Expect a decline toward 1.0780 and 1.0740.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pengujian harga di 142,60 terjadi ketika indikator MACD telah bergerak jauh di atas angka nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar

Uji harga di 1.3322 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, membatasi potensi kenaikan pasangan ini. Itulah sebabnya saya tidak membeli pound. Situasi serupa, tetapi kali

Uji pertama pada level harga 1,1372 di paruh kedua hari terjadi ketika indikator MACD sudah bergerak jauh di bawah level nol, yang membatasi potensi penurunan pasangan ini. Tak lama kemudian

Analisis Trading dan Kiat-kiat Strategi untuk Yen Jepang Pengujian pertama pada level 142,66 terjadi ketika indikator MACD sudah turun secara signifikan di bawah garis nol, yang membatasi potensi penurunan pasangan

Analisis dan Kiat-kiat untuk Trading Pound Inggris Uji level 1,3286 terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang menurut saya membatasi potensi kenaikan pound. Oleh karena

Ulasan Trading dan Tips untuk Trading Euro Pengujian level 1.1361 terjadi pada saat indikator MACD sudah bergerak jauh di atas tanda nol, membatasi potensi kenaikan pasangan ini. Oleh karena

Uji level 142,32 terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang menurut saya membatasi potensi kenaikan pasangan ini. Karena alasan ini, saya tidak membeli dolar

Pengujian harga pada 1,1382 di paruh kedua hari ini bertepatan dengan dimulainya pergerakan turun indikator MACD dari garis nol, mengonfirmasi titik masuk yang tepat untuk menjual euro. Akibatnya, pasangan

Uji harga di 1.3285 terjadi ketika indikator MACD baru saja mulai bergerak turun dari tanda nol, mengonfirmasi titik masuk yang valid untuk menjual pound. Akibatnya, pasangan ini turun lebih dari

Klub InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.