Lihat juga

31.03.2025 08:10 PM

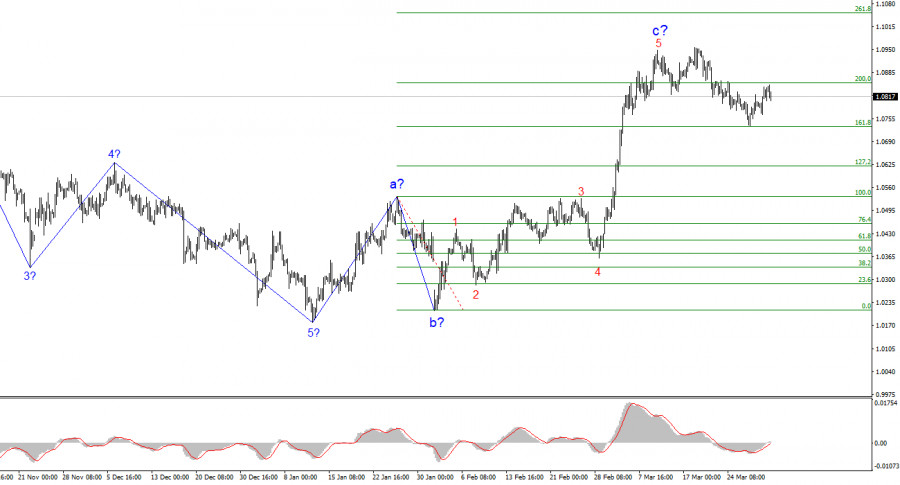

31.03.2025 08:10 PMThe wave structure on the 4-hour EUR/USD chart is at risk of transforming into a more complex formation. On September 25 of last year, a new downward structure began forming, taking the shape of a five-wave impulse. Three months ago, an upward corrective structure began to form, which should consist of at least three waves. The structure of the first wave was well-formed, so I continue to expect the second wave to have a clear shape as well. However, the size of this wave is so large that it threatens a significant transformation of the wave pattern.

The news background continues to support sellers more than buyers when it comes to economic data. All U.S. reports over the past few months indicate one thing—the economy is not experiencing major issues and is not slowing to concerning levels. However, the situation may change dramatically in 2025 due to Donald Trump's policies. The Federal Reserve may cut interest rates more than expected, and tariffs—along with retaliatory measures—could hamper economic growth. Were it not for recent developments, I would still expect the euro to decline with 90% confidence. But anything is still possible.

The EUR/USD rate remained nearly unchanged throughout Monday, though some volatility may still occur before the day ends. This week is packed with economic data, with releases beginning tomorrow, and on Wednesday Donald Trump is expected to announce new tariffs. Therefore, market activity may noticeably increase starting tomorrow. Today, Germany released a solid retail sales report, along with weaker inflation data. In truth, low inflation is beneficial for the economy and European consumers. However, subdued inflation also means the ECB is unlikely to halt its monetary easing policy anytime soon.

This is a double-edged factor at the moment. On the one hand, why pause ECB easing if demand for the euro is rising regardless? On the other hand, that demand won't last forever, and the only current reason for euro strength is Donald Trump. Eventually, the U.S. president will have no more targets for tariffs. Then what will the euro rely on?

Let me remind you that the downward trend phase is still valid, despite a strong wave 2. Corrective waves can vary in size—even up to 100%. Of course, such large waves are difficult to work with. But strong corrections are possible, so for now, it's still feasible to expect wave 3 to form, with targets at least near 1.0000.

Based on the analysis of EUR/USD, I conclude that the pair continues forming a downward trend segment, although it could soon shift into an upward phase. Any new rise in the euro would force a transformation of the entire wave structure. Since the news background currently contradicts the wave setup, I cannot recommend selling the pair—even though the current levels look extremely attractive for short positions, provided the wave count remains intact. However, Donald Trump continues to put pressure on the dollar, making the formation of wave 3 nearly impossible at this time.

On the higher wave scale, the wave structure has transformed into an impulsive formation. It is likely that we are facing a new long-term downward wave sequence, but the news background—especially from Donald Trump—can turn everything upside down.

Core Principles of My Analysis:

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

GBP/USD Analisis: Sejak awal tahun ini, GBP/USD telah membentuk gelombang naik pada grafik harian. Pasangan ini sekarang telah mencapai batas zona potensi pembalikan yang luas. Pada saat analisis, harga berada

Analisis: Sejak Februari, EUR/USD telah membentuk gelombang naik, dengan bagian akhir (C) saat ini sedang berlangsung. Baru-baru ini, pasangan ini menembus batas bawah zona pembalikan potensial yang kuat dan telah

Notifikasi

E-mail/SMS

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.