#PEP (PepsiCo Inc.). Exchange rate and online charts.

Currency converter

21 Mar 2025 21:59

(-0.03%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

PepsiCo Inc. (#PEP) is a world’s leading multinational food and beverage corporation. The company was founded in 1965 in the US. It is the second largest corporation in the global food business in terms of net revenue.

PepsiCo produces and sells fizzy and still drinks, snacks, and other products in the US and around the world. The company owns several popular brands such as Pepsi, 7Up, Gatorade, Tropicana, Lay’s, Cheetos and others. At present, the company is committed to healthy nutrition, thus reducing dubious ingredients in its products.

In the 2008 fiscal year, PepsiCo revenues surged 9.6% to $43,251 billion whereas net profits on the contrary slumped 9.1% to $5,142 billion. Nowadays, its market capitalization equals $9,773.06 billion.

PepsiCo is included in the S&P 500 index. The company’s shares are traded on the NYSE under the #PEP ticker. In 2017, 99.57% of PepsiCo shares have been in free circulation.

The global producer of soft drinks and snacks suggests lucrative investment opportunities. According to expert estimates, PepsiCo’s shares gain 1.54% on average per month.

See Also

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

2398

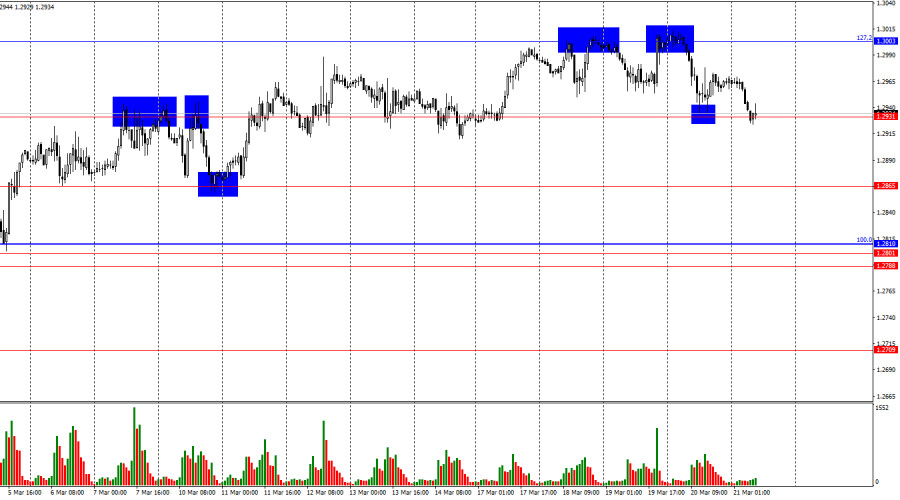

Bulls had the upper hand for two weeks, but it's time for a pauseAuthor: Samir Klishi

12:02 2025-03-21 UTC+2

2323

The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.Author: Chin Zhao

19:42 2025-03-21 UTC+2

2263

- Technical analysis

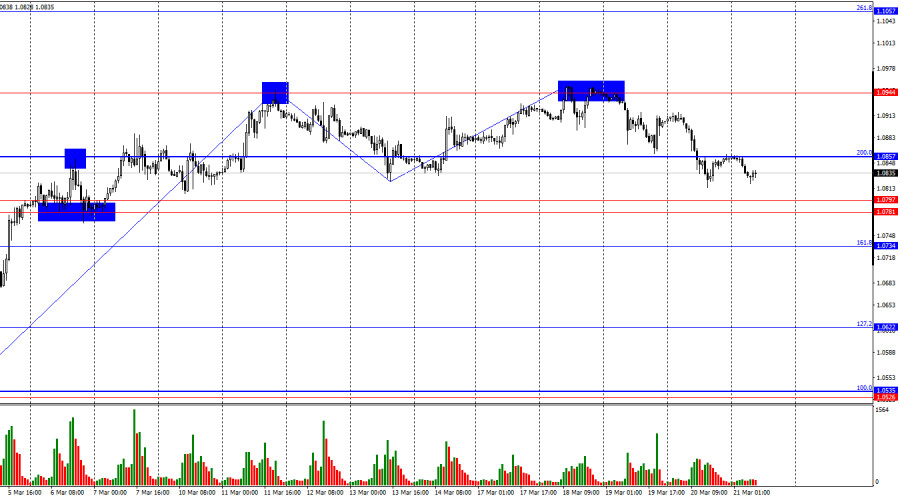

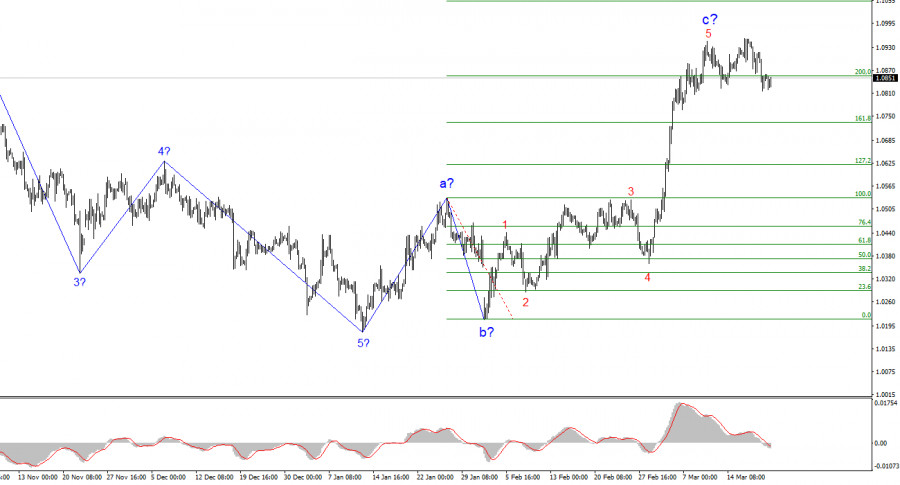

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2218

Technical analysisTrading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

2083

US stock market in limbo despite positive economic dataAuthor: Andreeva Natalya

15:48 2025-03-21 UTC+2

1978

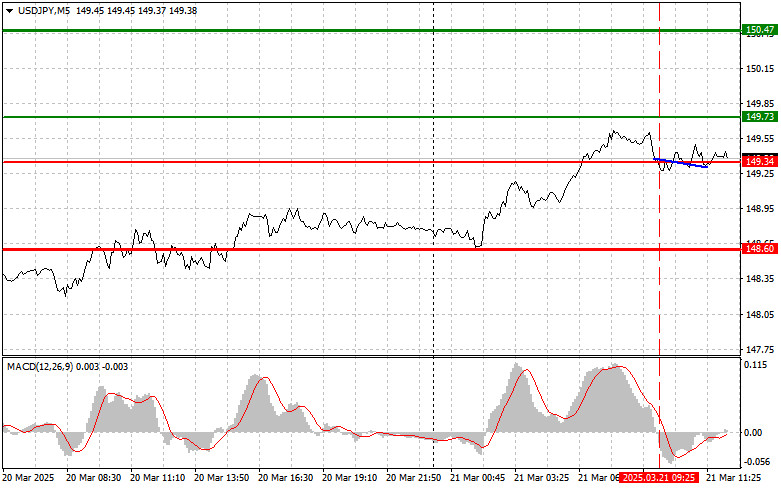

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:30 2025-03-21 UTC+2

1963

The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.Author: Chin Zhao

19:39 2025-03-21 UTC+2

1948

The outcomes of the Bank of England and FOMC meetings contradicted each otherAuthor: Samir Klishi

11:52 2025-03-21 UTC+2

1903

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Author: Irina Yanina

12:07 2025-03-21 UTC+2

2398

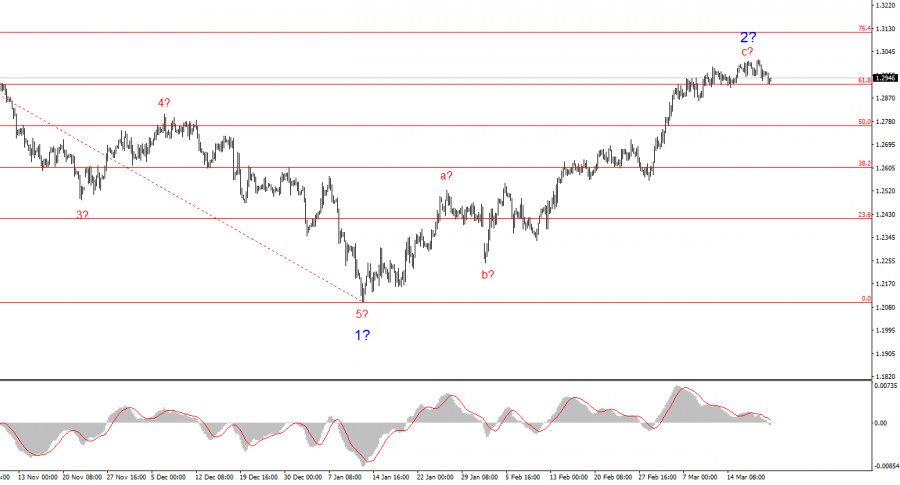

- Bulls had the upper hand for two weeks, but it's time for a pause

Author: Samir Klishi

12:02 2025-03-21 UTC+2

2323

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Author: Chin Zhao

19:42 2025-03-21 UTC+2

2263

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Author: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2218

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Author: Dimitrios Zappas

14:04 2025-03-21 UTC+2

2083

- US stock market in limbo despite positive economic data

Author: Andreeva Natalya

15:48 2025-03-21 UTC+2

1978

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Author: Jakub Novak

19:30 2025-03-21 UTC+2

1963

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Author: Chin Zhao

19:39 2025-03-21 UTC+2

1948

- The outcomes of the Bank of England and FOMC meetings contradicted each other

Author: Samir Klishi

11:52 2025-03-21 UTC+2

1903