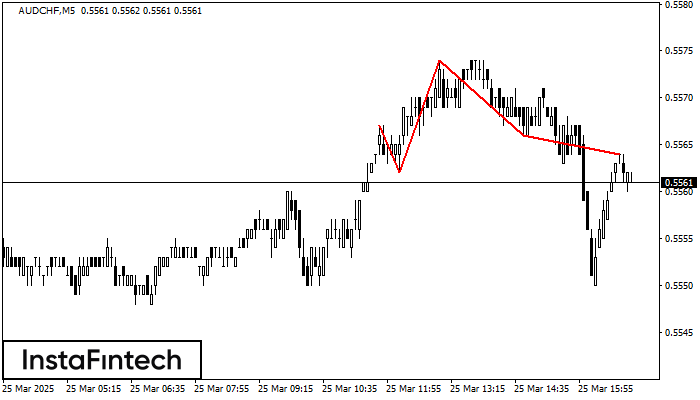

Head and Shoulders

was formed on 25.03 at 17:01:08 (UTC+0)

signal strength 1 of 5

The technical pattern called Head and Shoulders has appeared on the chart of AUDCHF M5. There are weighty reasons to suggest that the price will surpass the Neckline 0.5562/0.5566 after the right shoulder has been formed. So, the trend is set to change with the price heading for 0.5551.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength