See also

10.04.2025 06:49 AM

10.04.2025 06:49 AMThe EUR/USD currency pair showed strong growth and decline on Wednesday. Lately, both moves have been triggered by Donald Trump. First, news broke that the U.S. was imposing additional tariffs on China, raising the total rate to an astronomical 104%. Then Trump decided to push it further to 125% (apparently to avoid half-measures) but introduced a 90-day grace period for all other countries, during which a 10% tariff would apply to all imports.

The first announcement pointed to an escalation in the trade war, while the second eased tensions slightly and gave rise to hopes of negotiations and a softer resolution to the trade conflict. However, these "Trump discounts" are unlikely to lead to a strong dollar rally since tariffs remain in place and Trump continues to play his cards in any way he sees fit. From the outside, it looks absurd to impose tariffs and then offer a discount on tariffs.

On the 5-minute chart, three trading signals were formed during the day on Wednesday, not counting the sharp evening moves triggered again by Trump. The price bounced three times off the 1.1011 and 1.1091 levels, and the nearest target was hit in each case. Given the strong intraday volatility, novice traders could have made around 150 pips from just these three trades.

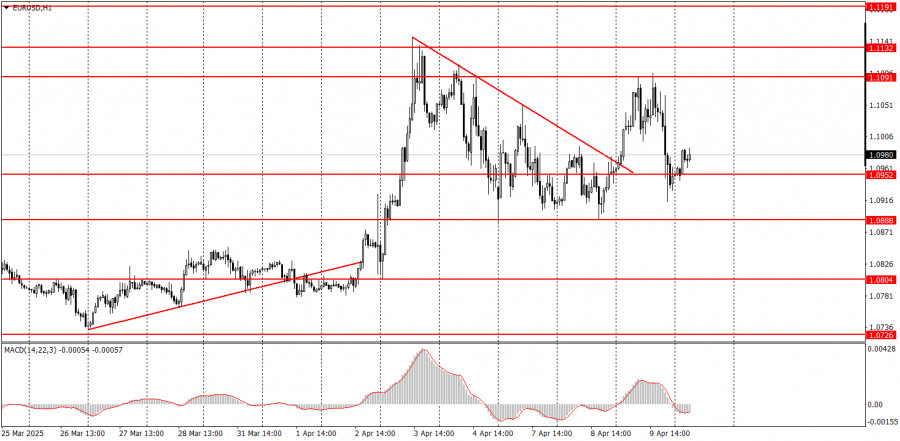

In the 1-hour timeframe, the EUR/USD pair is still in an uptrend. It's uncertain how long this will continue, as no one can predict how many additional tariffs Trump may introduce. Multiple escalations in the trade war are possible since many countries are preparing mirrored responses to U.S. actions. Trump has already stated that any retaliation will provoke further U.S. tariffs. Due to Trump's "discounts," the dollar may strengthen slightly but not significantly, as nothing has fundamentally changed.

On Thursday, markets will likely remain in shock. We won't attempt to predict price movements, as trade-related headlines appear almost every two hours. What's happening in the global markets right now is difficult to describe.

On the 5-minute chart, consider the following levels: 1.0596, 1.0678, 1.0726–1.0733, 1.0797–1.0804, 1.0859–1.0861, 1.0888–1.0896, 1.0940–1.0952, 1.1011, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292.

On Thursday, traders should watch the U.S. inflation report, which currently carries limited significance for market participants. The trade war headlines will remain the top priority.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Friday's Trades 1H Chart of GBP/USD On Friday, the GBP/USD pair showed extremely low volatility, yet the British pound steadily crept upward even with such market conditions

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed no movement on Friday. It was Good Friday, and Easter Sunday followed. As a result, many countries

The GBP/USD currency pair traded higher again on Friday, albeit with minimal volatility. Despite the lack of important events in the U.S. or the U.K. that day (unlike earlier

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correcting

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The current

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuck

InstaTrade video

analytics

Daily analytical reviews

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.