See also

Trade Analysis and Tips for the Euro

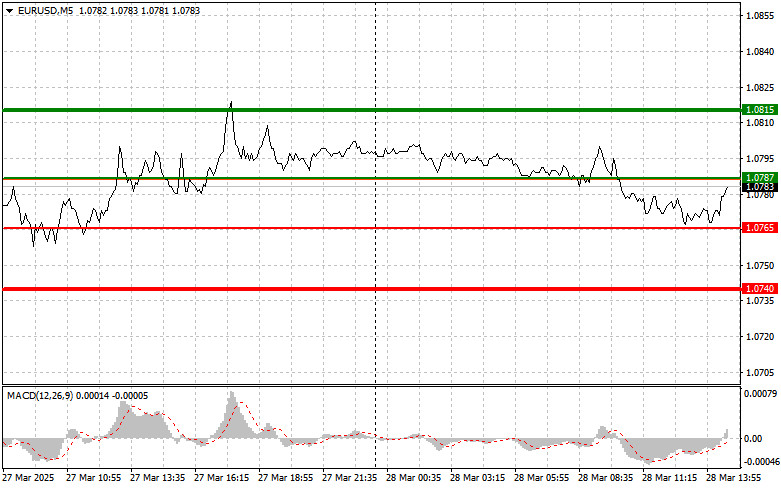

The price test at 1.0785 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downward potential. A second test at 1.0786 happened while the MACD was in the oversold zone, which triggered Buy Scenario #2. As a result, the pair gained 20 points.

Negative data from Germany, particularly regarding the labor market, sparked concerns about economic growth prospects. Investors began actively selling euro-denominated assets, putting additional pressure on the currency.

Today, we expect figures for the Core Personal Consumption Expenditures (PCE) Index, the Fed's preferred inflation gauge. Analysts and investors will closely monitor the dynamics of this indicator to assess how steadily inflation is slowing and what steps the Fed might take at upcoming meetings. Household income and spending data are equally important. A rise in spending may point to strong consumer demand, potentially pushing inflation higher. On the other hand, rising incomes could cushion the negative impact of inflation on households.

As for intraday strategy, I will primarily rely on implementing Scenarios #1 and #2.

Buy Signal

Scenario #1: Today, I plan to buy the euro upon reaching the entry point around 1.0787 (green line on the chart) with a target of rising to 1.0815. At 1.0815, I will exit the market and open short positions in the opposite direction, aiming for a 30–35 point move. Euro growth today can only be expected following weak U.S. data and dovish statements from Fed officials. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the euro today if the price tests 1.0765 twice in a row, while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and prompt a market reversal upward. You can then expect a rise to the opposite levels of 1.0787 and 1.0815.

Sell Signal

Scenario #1: I plan to sell the euro after it reaches 1.0765 (red line on the chart). The target will be 1.0740, where I'll exit the market and immediately open long positions in the opposite direction, aiming for a 20–25 point rebound. Pressure on the pair could return if the Fed maintains a hawkish stance. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the euro today in case of two consecutive tests of the 1.0787 level, while the MACD is in the overbought zone. This would limit the pair's upward potential and result in a market reversal downward. A decline to the opposite levels of 1.0765 and 1.0740 can be expected.

Chart Details:

Important: Beginner traders in the Forex market should be extremely cautious when making entry decisions. It's best to stay out of the market before the release of important fundamental reports to avoid sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without them, you could quickly lose your entire deposit, especially if you don't use money management and trade large volumes.

And remember: successful trading requires a clear trading plan—like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.