See also

06.03.2025 11:52 AM

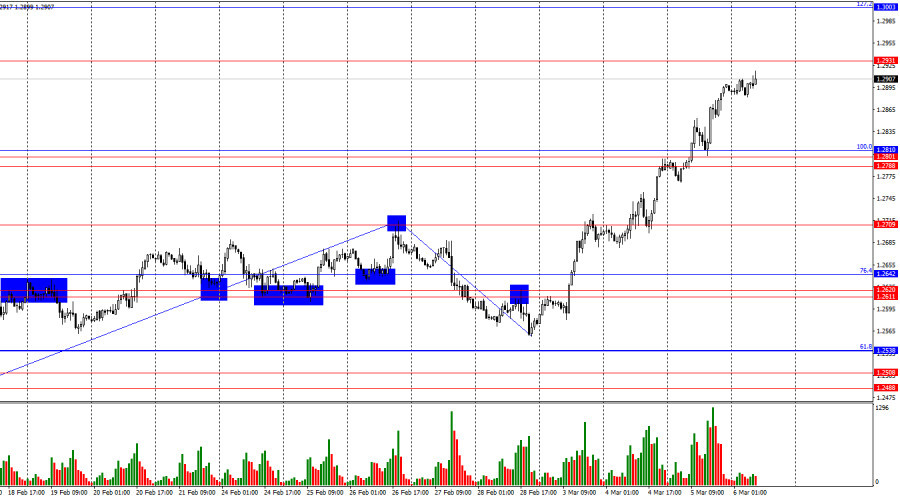

06.03.2025 11:52 AMOn the hourly chart, GBP/USD continued its upward movement on Wednesday after consolidating above the resistance zone of 1.2788–1.2801 and the 100.0% corrective level at 1.2810. The bulls are now approaching the 1.2931 level, which just yesterday seemed like a distant target. However, the U.S. dollar is falling relentlessly due to Donald Trump's policies and his administration's decisions. For four consecutive days, these actions have weakened the dollar. Bulls won't attack indefinitely, but at this point, there are no technical signals for selling. A consolidation above 1.2931 will increase the likelihood of continued growth toward the next Fibonacci level of 127.2% at 1.3003.

The wave structure is clear. The last completed downward wave did not break below the previous low, while the new upward wave has surpassed the last peak. This confirms the formation of a bullish trend. The pound has been experiencing strong growth lately—perhaps too strong. The fundamental backdrop does not appear robust enough to justify such an uninterrupted rally.

On Wednesday, market sentiment remained unaffected by news. Bank of England Governor Andrew Bailey's calls for a peaceful resolution to trade disputes and the strong ISM Services PMI from the U.S. had no impact on traders. There was a slight negative factor—the ADP employment report in the U.S. came in significantly weaker than expected. However, it's worth noting that there is no direct correlation between ADP data and Nonfarm Payrolls. A weak ADP report does not necessarily mean that NFP will be weak as well. At this point, weak economic data is just adding to an already negative environment for the dollar.

Donald Trump announced a one-month delay in tariffs on Mexican and Canadian automakers. Additionally, some goods will be excluded from the sanctions list. However, this news has little impact. The dollar is in freefall, and any easing of Trump's trade pressure is unlikely to spark a significant recovery in the U.S. currency.

On the 4-hour chart, GBP/USD continues its upward trend, consolidating above the 50.0% Fibonacci level at 1.2861. This supports the potential for further gains toward the next corrective level at 38.2%—1.2994. A strong decline in the pound is unlikely unless there is a confirmed breakout below the ascending channel. No bearish divergences are currently observed on any indicators.

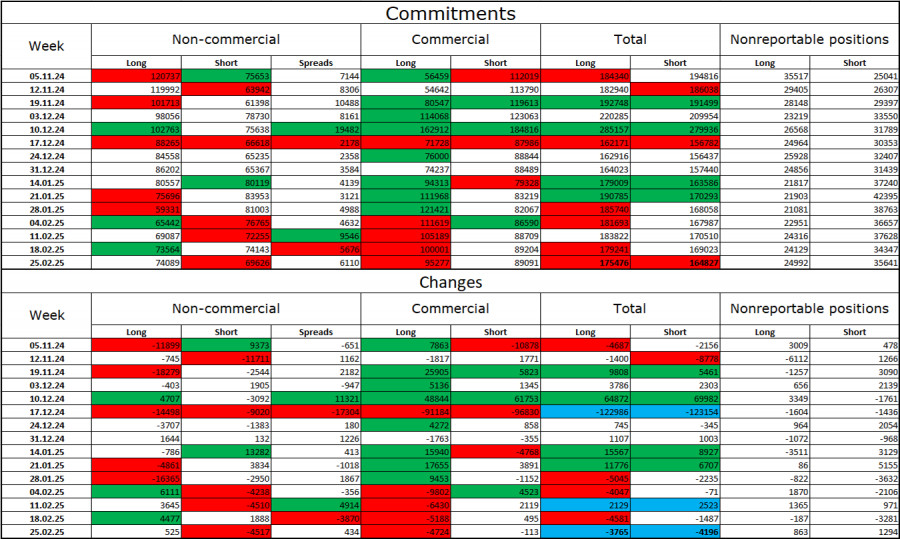

The sentiment among "Non-commercial" traders became less bearish last week. The number of long positions increased by 525, while short positions declined by 4,517. Although bulls have lost some advantage in the market, bears have not significantly increased their positions either. The gap between long and short positions remains minimal: 74,000 versus 69,000.

Despite the pound's recent rally, there are still prospects for a decline. The COT report signals a slow but steady strengthening of bearish positions. Over the past three months, the number of long contracts has decreased from 120,000 to 74,000, while short positions have dropped from 75,000 to 69,000. Over time, professional traders are likely to continue reducing long positions or increasing short positions, as most of the bullish fundamental factors supporting the pound have already been priced in.

The pound has received temporary support from relatively strong UK economic data. However, the current chart analysis continues to indicate an uptrend.

On Thursday, the economic calendar includes only one secondary report, meaning the fundamental backdrop is unlikely to significantly influence market sentiment.

Selling opportunities for GBP/USD are possible today if the pair rebounds from the 1.2931 level on the hourly chart, targeting 1.2810. Buying was possible after a close above the 1.2788–1.2801 zone on the hourly chart, with a target of 1.2931. This level is now nearly reached. If the pair consolidates above it, holding long positions toward 1.3003 may be justified.

Fibonacci retracement levels are plotted from 1.2809 to 1.2100 on the hourly chart and from 1.2299 to 1.3432 on the 4-hour chart.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance that

Early in the American session, gold is undergoing a strong technical correction after reaching a new high around 3,237.69 for now. Economic data from the United States will be released

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

The Eagle indicator is reaching oversold levels and is giving a negative signal, so we will look for opportunities to sell below 3,145 or below 3,131 with a target

E-mail/SMS

notifications

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.