See also

14.02.2025 01:27 PM

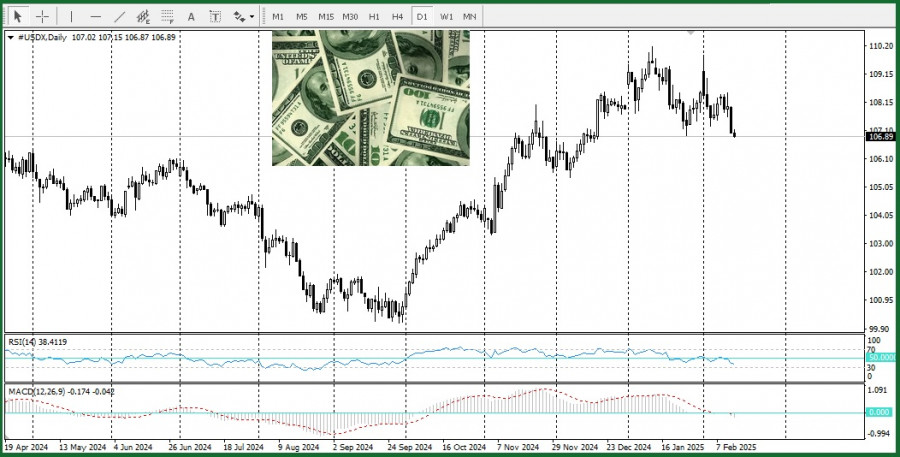

14.02.2025 01:27 PMThe U.S. Dollar Index (USDX), which tracks the dollar's performance against six major currencies, is showing some stability following recent losses.

This comes amid a decline in U.S. Treasury yields, which adds additional pressure on the dollar, despite ongoing concerns about a potential global trade war. The recent decision by President Donald Trump to delay the implementation of reciprocal tariffs has also influenced the dollar's performance.

Today, traders should focus on the upcoming U.S. retail sales report, which is the last significant economic release of the week. Expectations suggest that retail sales may decline by 0.1% in January, following a 0.4% increase in the previous month.

Inflation remains a central topic, as core Producer Price Index (PPI) inflation in the U.S. rose to 3.6% year-over-year in January, exceeding the expected 3.3%. This further supports the view that the Federal Reserve may delay interest rate cuts until the second half of the year. Persistently high inflation could keep interest rates within the 4.25%-4.50% range for an extended period.

In his recent address to Congress, Fed Chair Jerome Powell emphasized that policymakers should not rush into rate cuts, citing a strong labor market and resilient economic growth. He also warned about the potential consequences of Trump's tariff policies, which could drive up prices and complicate the Fed's ability to lower interest rates.

According to a Reuters survey of economists, many now anticipate that the Fed will postpone rate cuts until the next quarter, due to increasing inflation concerns. Most respondents, surveyed between February 4-10, believe that one rate cut may occur by June, although opinions on the exact timing remain mixed.

From a technical perspective, oscillators on the daily chart have moved into negative territory, reinforcing a bearish outlook for the U.S. dollar in the near term.

Thus, the current situation in the currency market and the U.S. economy requires close monitoring, as multiple factors—including inflation trends, trade policies, and Fed decisions—could have a significant impact on the dollar's future trajectory.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the U.S. stock market experienced a sharp decline, pulling down many global exchanges, as the "turbulent" actions of President Trump continue to shift from one hot topic

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.