See also

20.01.2025 02:03 PM

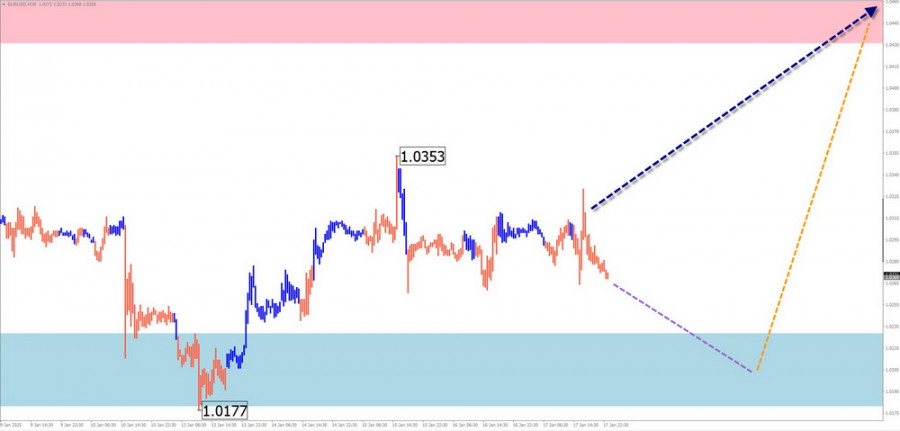

20.01.2025 02:03 PMAnalysis:Since August last year, the euro major pair has been developing a descending contracting flat pattern. The price decline brought quotes to the upper boundary of a strong weekly-scale potential reversal zone. Over the past three weeks, the price has moved sideways between opposing zones.

Forecast:This week, the euro is expected to continue its sideways movement. In the next couple of days, pressure on the support zone is likely, with a possible brief break below its lower boundary. Subsequently, the price is expected to return to the range between nearby zones, gradually rising toward the resistance level.

Potential Reversal Zones:

Recommendations:

Analysis:Since last summer, the USD/JPY pair has been developing an upward zigzag wave. Since December, the price direction has reversed, forming a correctional phase. Currently, the wave structure remains incomplete. The bearish segment has reversal potential and could extend beyond a simple correction of the last trend wave.

Forecast:In the coming days, expect the price to move sideways, gradually declining toward the calculated support levels. By the week's end, a reversal and resumption of growth are expected, potentially bringing the price back to the resistance zone. A brief breach of the lower support boundary cannot be ruled out if the trend changes.

Potential Reversal Zones:

Recommendations:

Analysis:Since December, a descending zigzag wave has been forming on the GBP/JPY pair chart. The wave structure remains incomplete, approaching a D1 timeframe level. Currently, the price has breached the boundaries of an intermediate support zone, which now acts as resistance. A correction is anticipated within the wave structure.

Forecast:This week, the upward segment is expected to complete. Near the calculated resistance zone, a reversal and resumption of the downtrend are likely. The highest activity is expected toward the end of the week.

Potential Reversal Zones:

Recommendations:

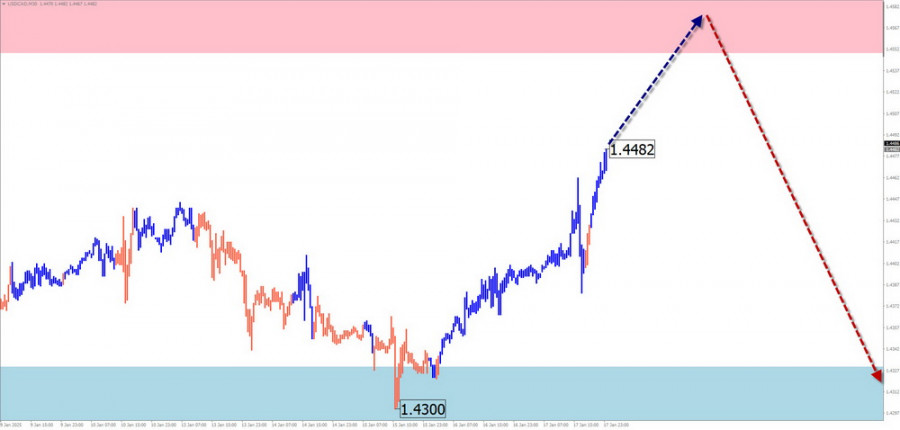

Analysis:Since late September, the USD/CAD pair has been forming an ascending wave. Over the past month, a counter-correction has emerged in the form of a stretched horizontal flat. This wave structure is incomplete as of now.

Forecast:Expect the uptrend to continue this week, potentially reaching the calculated resistance zone. A brief pullback toward the support boundary may occur early in the week, with increased volatility expected later in the week.

Potential Reversal Zones:

Recommendations:

Analysis:Since late September, the NZD/USD pair has seen a steady decline. From mid-December, a counter-correction in the form of a stretched flat has been forming. Prices are moving along an intermediate support/resistance zone. The correction structure remains incomplete.

Forecast:A steady decline from the calculated resistance zone to the support zone is likely in the coming week. Early in the week, brief pressure and a breach of the upper resistance boundary cannot be ruled out.

Potential Reversal Zones:

Recommendations:

Analysis:Since late October, gold prices have been forming a descending horizontal flat within a larger uptrend. Prices are moving within a flat range near a weekly-scale potential reversal zone.

Forecast:Gold is expected to maintain its overall sideways movement this week. After likely pressure on the resistance zone, a reversal and gradual decline toward the support zone are anticipated.

Potential Reversal Zones:

Recommendations:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

GBP/USD Analysis: Since the beginning of this year, GBP/USD has been forming an upward wave on the daily chart. The pair has now reached the boundaries of a wide potential

Analysis:Since February, EUR/USD has been forming an upward wave, with the final part (C) currently in progress. Recently, the pair pushed through the lower boundary of a strong potential reversal

InstaTrade video

analytics

Daily analytical reviews

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.