ZARJPY (South African Rand vs Japanese Yen). Exchange rate and online charts.

Currency converter

28 Mar 2025 22:09

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

ZAR/JPY (South African Rand vs Japanese Yen)

The ZAR/JPY currency pair represents a cross rate against the U.S. dollar which bears upon the further rate of ZAR/JPY. Thus, by merging the USD/JPY and USD/ZAR price charts, it is possible to get a rough ZAR/JPY price chart. However, this instrument is not actively traded on the Forex market.

The U.S. economic indicators such as the interest rate, GDP growth, unemployment rate, new vacancies, and others can serve well when analyzing ZAR/JPY movements as the greenback can influence the currency pair significantly. However, the currencies can respond differently to the changes in the U.S. economy.

South African rand is one of the most tradable currencies in the world. Thanks to the huge mineral deposits, South Africa is the richest country in its region. It is also famous for the stock exchange which is listed among the world's top ten exchanges. South African economy is based mainly on the extraction and export of minerals.

South Africa produces a great number of precious stones and metals, including gold and diamonds. In addition, it is the largest car manufacturer in Africa. South Africa is quite self-sufficient in providing itself with the necessary raw materials for production. The factors that affect the South African rand the most are the prices for the precious stones and metals, and the level of industrial production.

The ZAR/JPY currency pair is very exposed to a variety of world's major political and economic developments. For this reason, the price chart for this currency pair is poorly predictable and often goes in the opposite direction regardless of any analysis.

Beginners are not recommended to start their trading with this currency pair. To successfully project the further course rate of this trading instrument, it is necessary to know many nuances of the price chart behaviour as they can affect the pair's movement.

When compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY, the ZAR/JPY trading instrument is relatively illiquid. Hence, trying to predict the ZAR/JPY further trend, it is necessary to consider the USD/JPY and USD/JPY price charts.

As a rule, the brokers set a higher spread for cross rates rather than for major currency pairs. That is why before trading crosses, learn carefully the terms and conditions offered by the broker.

See Also

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

928

Donald Trump is not the only one to blame for the S&P 500's decline.Author: Marek Petkovich

09:19 2025-03-28 UTC+2

838

AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price IndexAuthor: Irina Yanina

12:16 2025-03-28 UTC+2

823

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

823

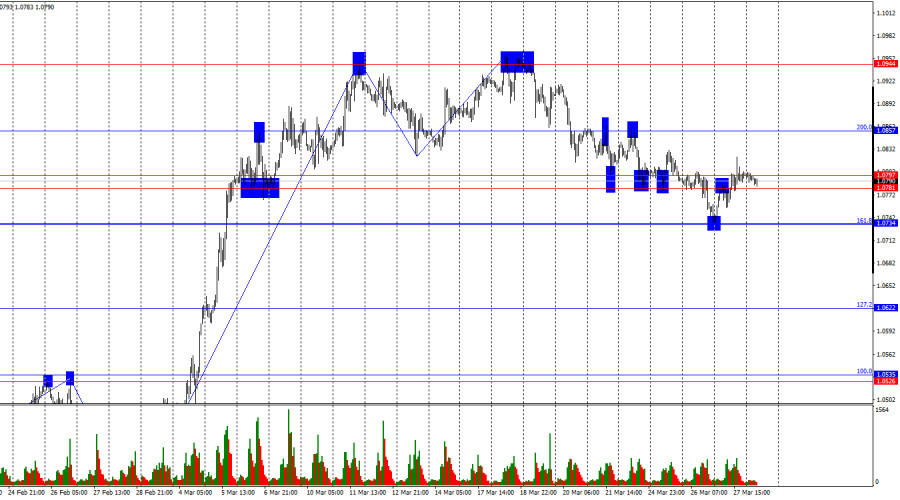

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

793

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

793

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

793

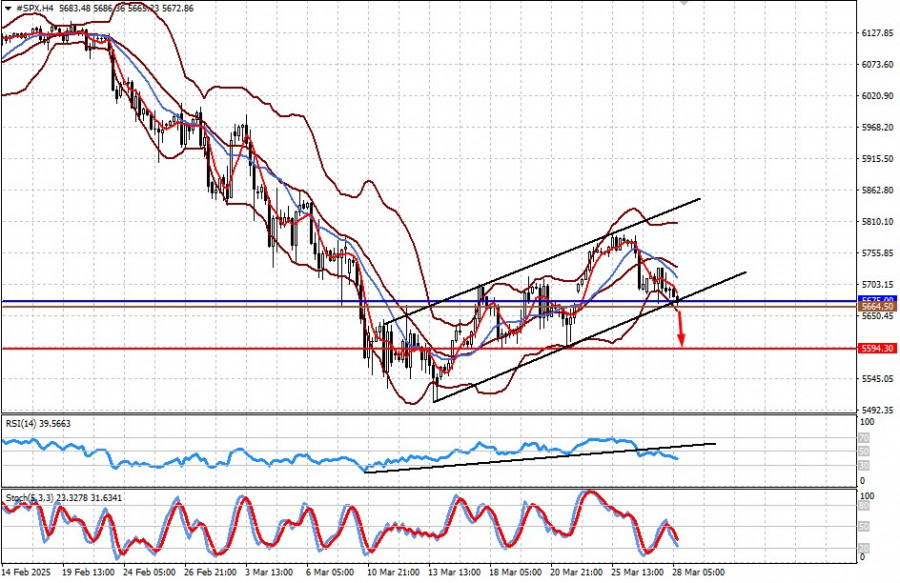

Fundamental analysisMarkets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

748

Stock Market on March 28th: S&P 500 and NASDAQ in a Difficult PositionAuthor: Jakub Novak

11:29 2025-03-28 UTC+2

733

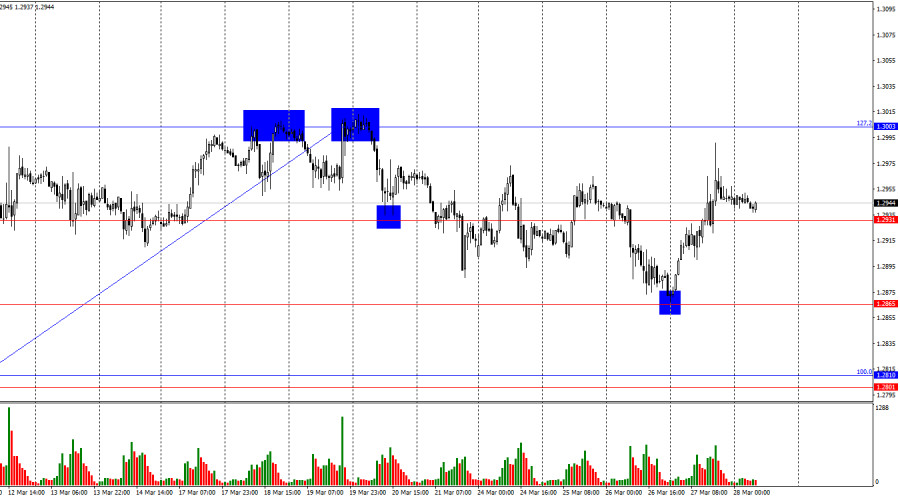

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

928

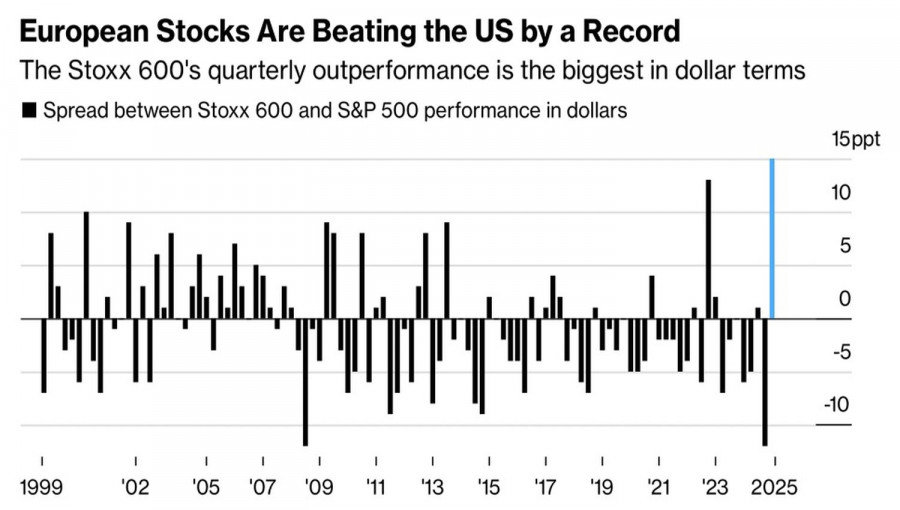

- Donald Trump is not the only one to blame for the S&P 500's decline.

Author: Marek Petkovich

09:19 2025-03-28 UTC+2

838

- AUD/USD extends its range around 0.6300 ahead of the U.S. PCE Price Index

Author: Irina Yanina

12:16 2025-03-28 UTC+2

823

- Bears are trying to break through the bulls' defenses

Author: Samir Klishi

11:36 2025-03-28 UTC+2

823

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

793

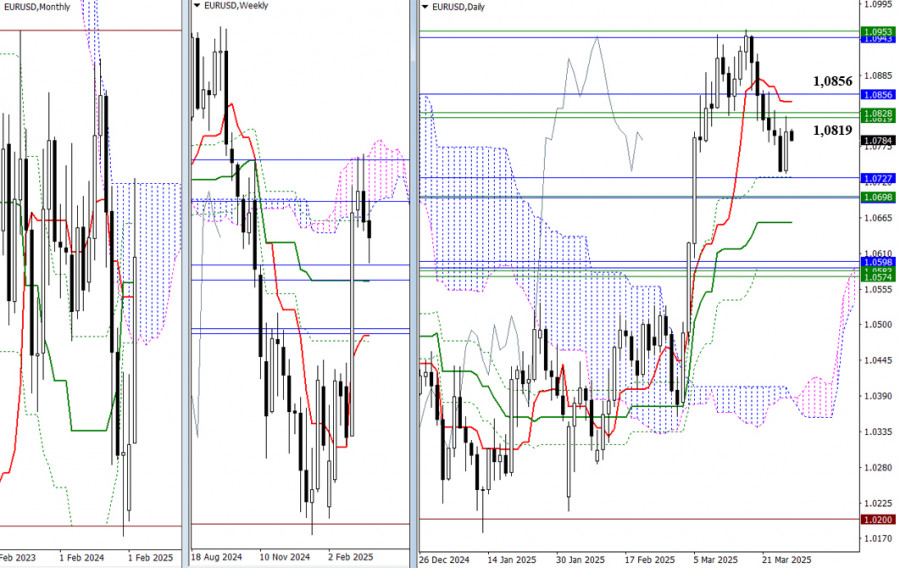

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

793

- Auto tariffs have shaken the market: stocks are under pressure, while gold is gaining. Investors are pulling out of the auto sector as recession fears intensify

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

793

- Fundamental analysis

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)Author: Pati Gani

11:39 2025-03-28 UTC+2

748

- Stock Market on March 28th: S&P 500 and NASDAQ in a Difficult Position

Author: Jakub Novak

11:29 2025-03-28 UTC+2

733