CADZAR (Canadian Dollar vs South African Rand). Exchange rate and online charts.

Currency converter

26 Mar 2025 21:58

(0.01%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

CADZAR is considered as a popular currency pair among Forex market players. In fact, CADZAR is the cross rate against the U.S. dollar, even though USD is not included in the pair symbol, it has a significant influence on it. By combing two charts CADUSD and USDZAR in one it becomes more obvious, and you get the approximate CADZAR chart.

The U.S. dollar exerts much influence on both currencies. So for correct prediction of future instrument dynamics, it is necessary to take into account the major U.S. economic indicators, for example, the discount rate, GDP, unemployment rate, the number of new jobs etc. Pay attention that the discussed currencies can show different reaction to the changes in the U.S. economy, therefore, the CADZAR pair is a specific indicator of these currencies fluctuations.

The Canadian dollar is very dependent on the world oil prices. Canada is one of the largest world exporters of oil. For this reason along with increasing of the oil price, the Canadian dollar is also moving up, and, on the contrary, when oil prices slide, the Canadian dollar is falling. Thus, CADZAR depends directly on oil world prices.

South African Rand is one of the most widespread currencies in the world used in numerous trade operations. South Africa is the richest country in Africa as it is rich in mineral deposits. Moreover, South Africa is one of the biggest stock exchanges, and is included in top 10 of the largest world stock exchanges. The country's economy is based on extraction and export of minerals.

South Africa is famous for precious stones and metals, including gold and diamonds. In addition, South Africa is the largest car manufacturer in Africa, targeted mostly to export. In fact, the country is almost totally self-sufficient in raw materials. The factors most affecting the South African Rand exchange rate are prices f precious stones and metals, as well as the level of machinery industry production.

If you trade cross rates, do not forget that brokers usually set a higher spread for this pair than for more popular currency pairs. So before you start working with cross-rates, read all conditions offered by the broker for this certain instrument.

See Also

- Gold maintains a positive tone today, but lacks strong bullish momentum

Author: Irina Yanina

11:54 2025-03-26 UTC+2

1438

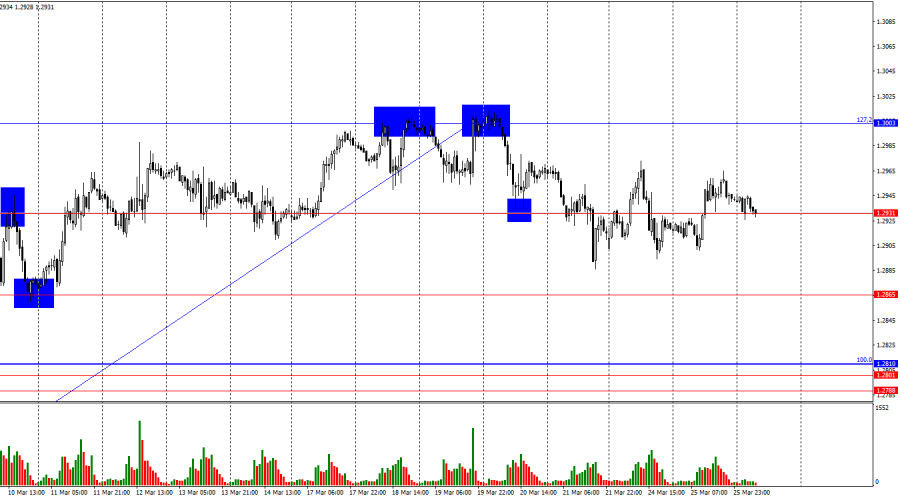

Bulls pushed for two weeks, but now it's time for a pauseAuthor: Samir Klishi

11:32 2025-03-26 UTC+2

1393

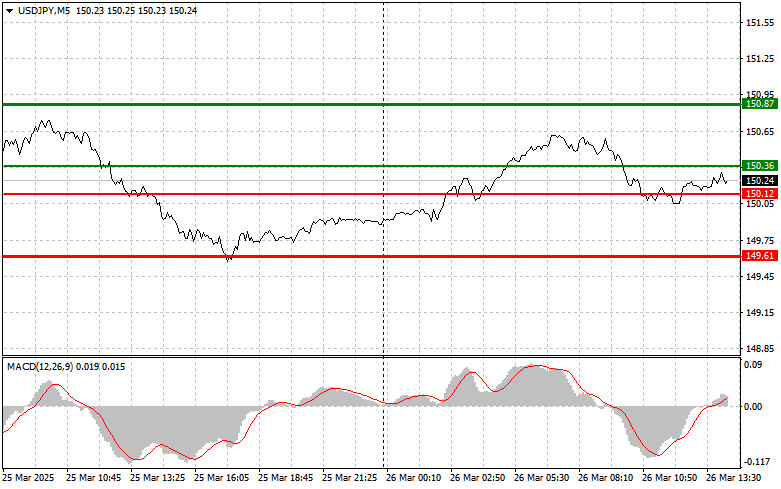

USD/JPY. Analysis and ForecastAuthor: Irina Yanina

11:42 2025-03-26 UTC+2

1348

- USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:35 2025-03-26 UTC+2

1108

Top banks are split on the S&P 500 outlook: the market remains in a zone of uncertainty. The S&P 500 is holding above a key level, but the rally lacks convictionAuthor: Irina Maksimova

11:47 2025-03-26 UTC+2

1078

Technical analysisTrading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1078

- KB Home falls after disappointing annual revenue forecast Consumer confidence in March was 92.9 CrowdStrike rises after brokerage firm's rating upgrade S&P 500 +0.16%, Nasdaq +0.46%, Dow +0.01%

Author: Thomas Frank

10:02 2025-03-26 UTC+2

1063

Bulls and bears remain in balanceAuthor: Samir Klishi

11:29 2025-03-26 UTC+2

1033

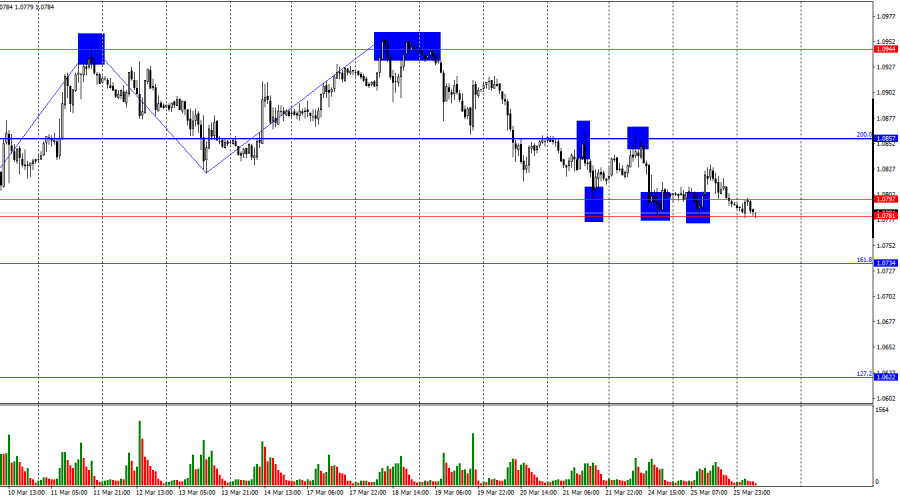

Technical analysisTrading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Author: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1018

- Gold maintains a positive tone today, but lacks strong bullish momentum

Author: Irina Yanina

11:54 2025-03-26 UTC+2

1438

- Bulls pushed for two weeks, but now it's time for a pause

Author: Samir Klishi

11:32 2025-03-26 UTC+2

1393

- USD/JPY. Analysis and Forecast

Author: Irina Yanina

11:42 2025-03-26 UTC+2

1348

- USD/JPY: Simple Trading Tips for Beginner Traders on March 26th (U.S. Session)

Author: Jakub Novak

18:35 2025-03-26 UTC+2

1108

- Top banks are split on the S&P 500 outlook: the market remains in a zone of uncertainty. The S&P 500 is holding above a key level, but the rally lacks conviction

Author: Irina Maksimova

11:47 2025-03-26 UTC+2

1078

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 26-28, 2025: sell below $3,034 (21 SMA - 7/8 Murray)

Gold could continue its bearish cycle in the coming days. To confirm the downtrend, we should expect consolidation below 3,020, then the price could reach the 6/8 Murray at 2,968, and eventually reach the 200 EMA around 2,939.Author: Dimitrios Zappas

16:11 2025-03-26 UTC+2

1078

- KB Home falls after disappointing annual revenue forecast Consumer confidence in March was 92.9 CrowdStrike rises after brokerage firm's rating upgrade S&P 500 +0.16%, Nasdaq +0.46%, Dow +0.01%

Author: Thomas Frank

10:02 2025-03-26 UTC+2

1063

- Bulls and bears remain in balance

Author: Samir Klishi

11:29 2025-03-26 UTC+2

1033

- Technical analysis

Trading Signals for EUR/USD for March 26-28, 2025: sell below 1.0808 (21 SMA - 8/8 Murray)

According to the H4 chart, the euro appears oversold, and we believe that if EUR/USD finds strong support around the 8/8 Murray level at 1.0742 or 1.0690, it will be seen as a buying opportunity.Author: Dimitrios Zappas

16:13 2025-03-26 UTC+2

1018