আরও দেখুন

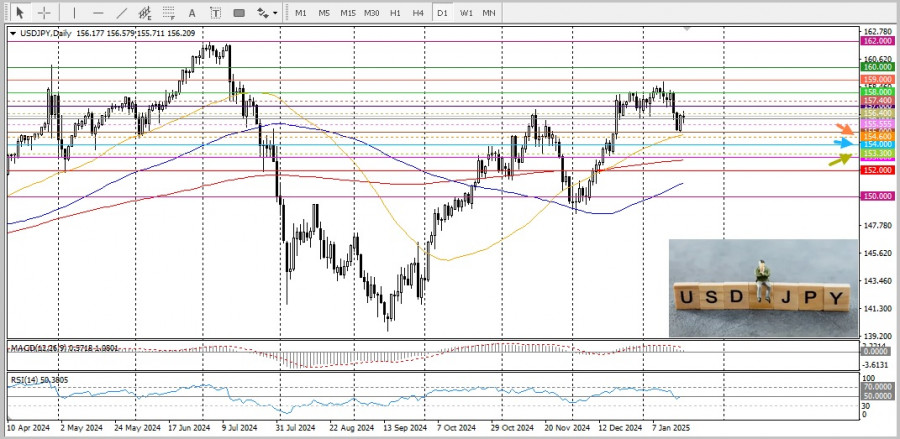

The Japanese yen shows slight declines in intraday trading against the US dollar. However, the USD/JPY pair lacks clear upward momentum and has been unable to build on Friday's rebound from the 155.00 level. The yen remains positively biased, trading near the multi-week high reached last Friday. An increase in Japan's core machinery orders for the second consecutive month indicates stabilization and further recovery in capital expenditures. Additionally, rising market expectations for the Bank of Japan to raise interest rates at its upcoming meeting also support the yen.

Meanwhile, the overall positive market sentiment and uncertainty surrounding the trade policy of incoming US President Donald Trump limit the yen's potential for significant strengthening. Traders are exercising caution and avoiding opening new positions ahead of Trump's inaugural address, scheduled for later during the US session.

Looking ahead, traders should focus on the upcoming two-day Bank of Japan monetary policy meeting starting Thursday, as its results will significantly impact the yen and determine the short-term trajectory of the USD/JPY pair.

From a technical perspective, Friday's rebound from the psychological level of 155.00 surpassed the next round level of 156.00 but stalled near resistance at 156.40. A sustained break above this resistance could trigger another round of short-covering, allowing USD/JPY to move toward the next round level of 157.00. The upward movement could then extend toward the 158.00 level and the multi-month high reached on January 10, with an intermediate barrier in the 157.50–157.40 zone.On the other hand, the lows of yesterday's US session around 155.55 provide immediate support ahead of the psychological level of 155.00. A decisive break and acceptance below this level would act as a fresh trigger for bears, pulling USD/JPY toward the 154.60–154.55 region. Spot prices could then extend the downward trajectory to the 154.00 level and further to the next key support in the 153.30 zone.

You have already liked this post today

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।