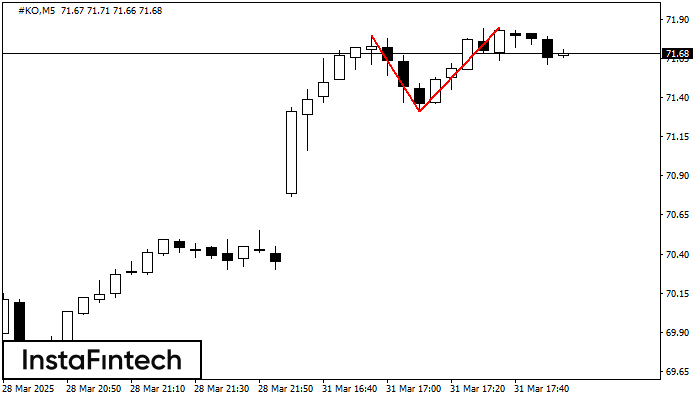

Double Top

was formed on 31.03 at 16:55:27 (UTC+0)

signal strength 1 of 5

The Double Top reversal pattern has been formed on #KO M5. Characteristics: the upper boundary 71.80; the lower boundary 71.31; the width of the pattern is 54 points. Sell trades are better to be opened below the lower boundary 71.31 with a possible movements towards the 71.16 level.

The M5 and M15 time frames may have more false entry points.

Figure

Instrument

Timeframe

Trend

Signal Strength